SA105: How do I claim for unused finance costs brought forward (BOX 45)?

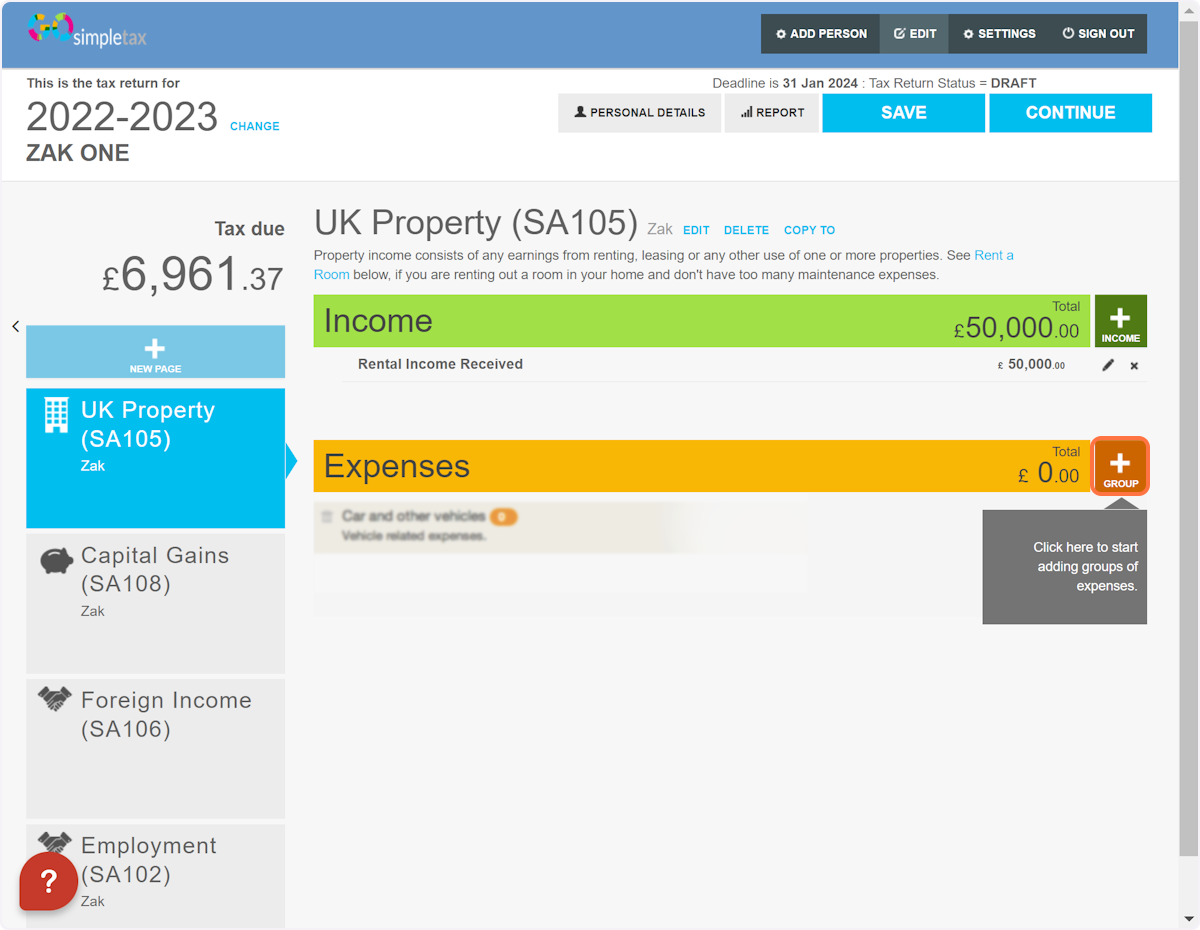

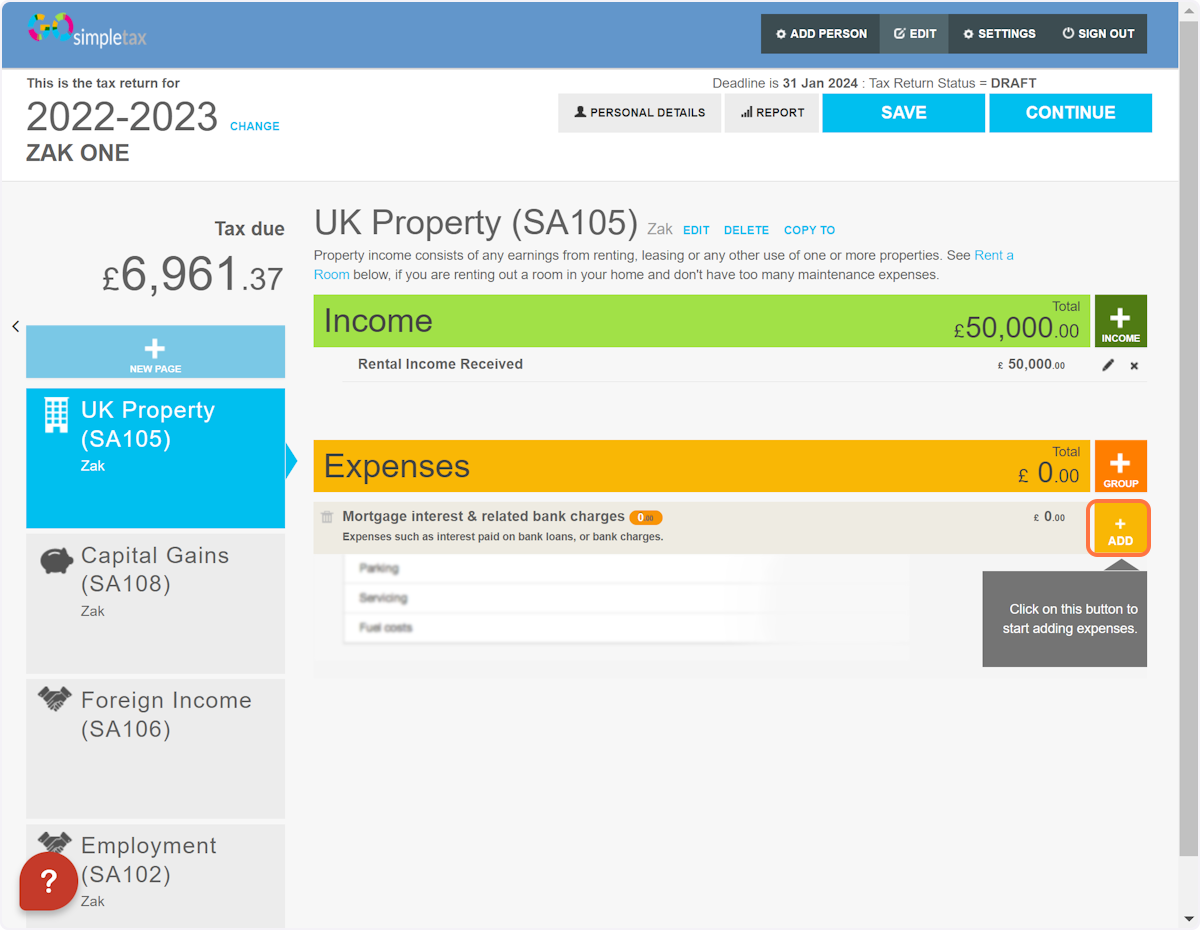

1. Once you're on your property page, click '+ GROUP'

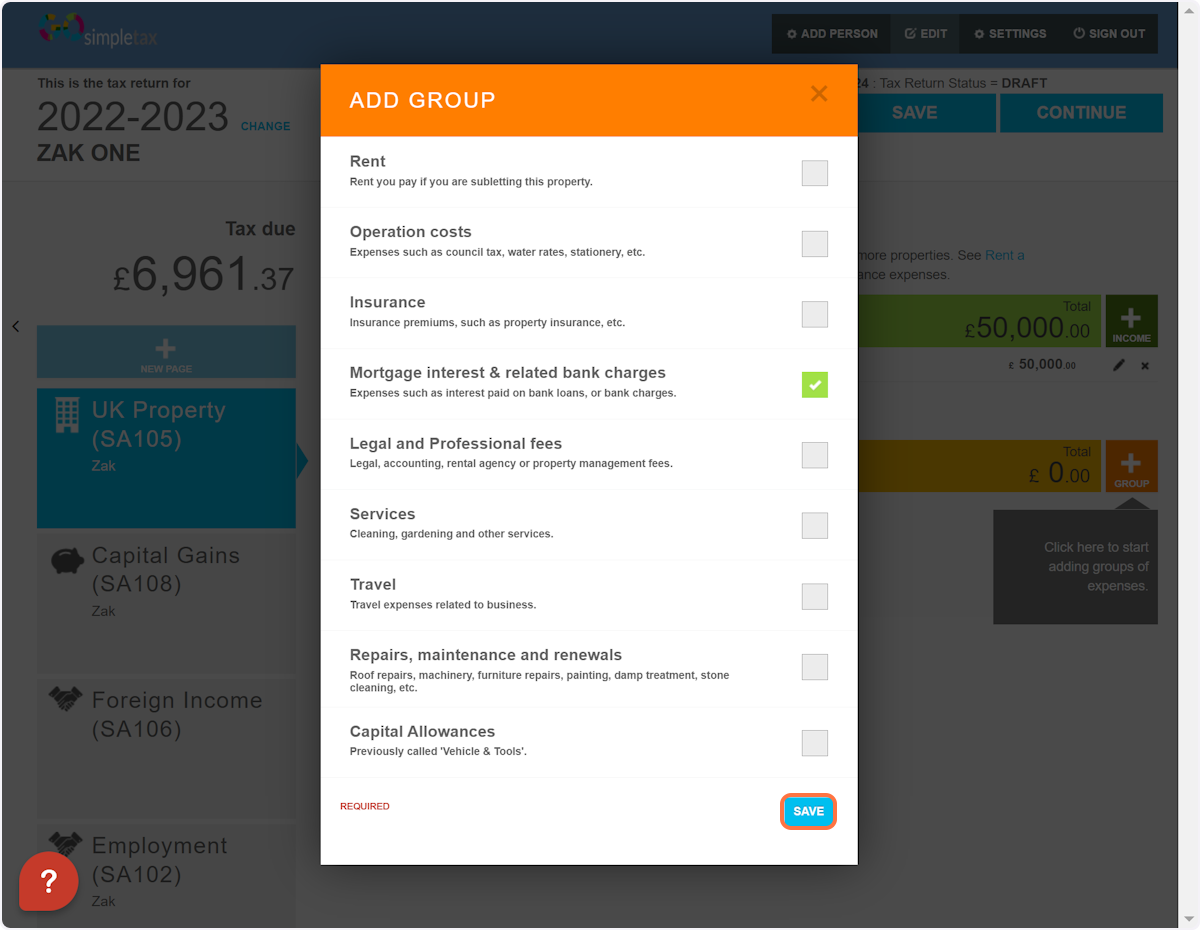

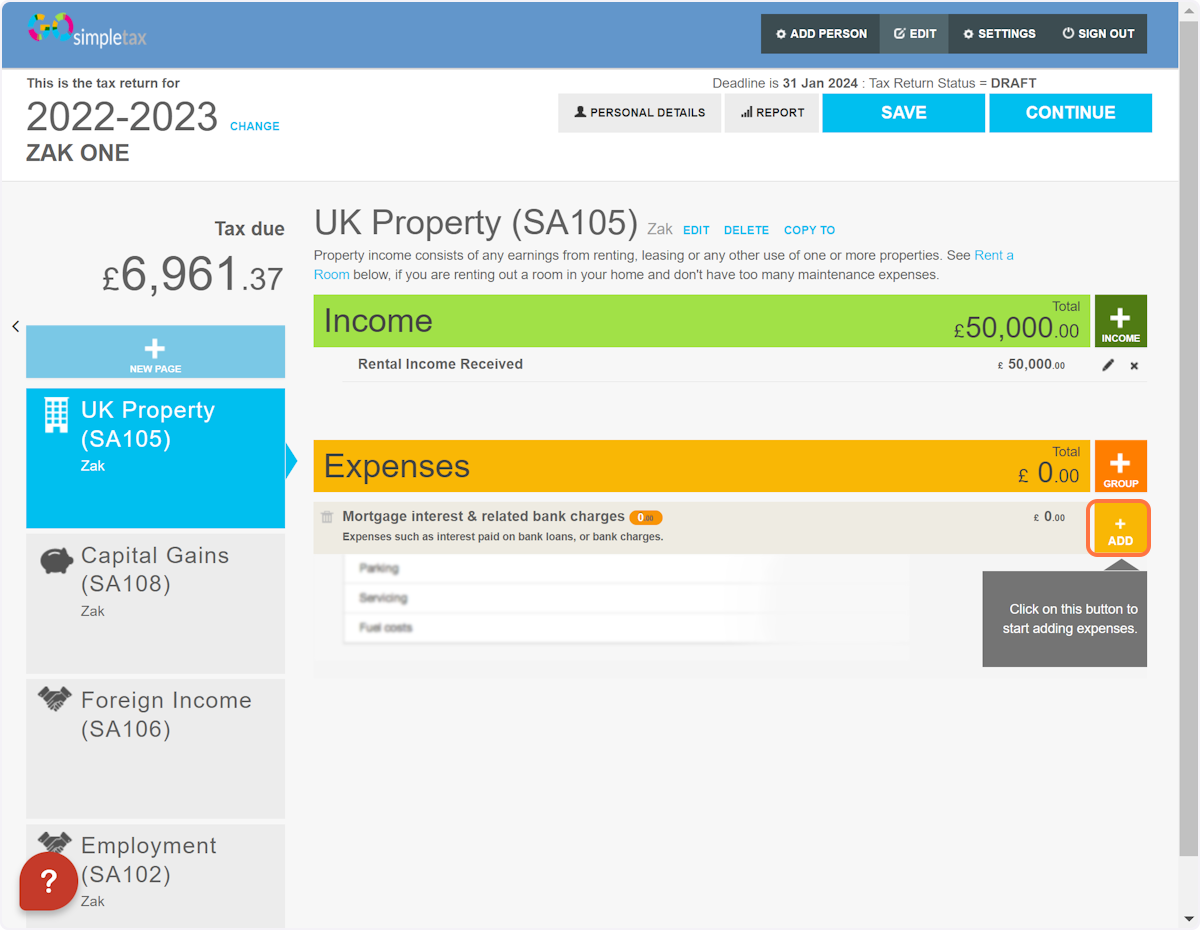

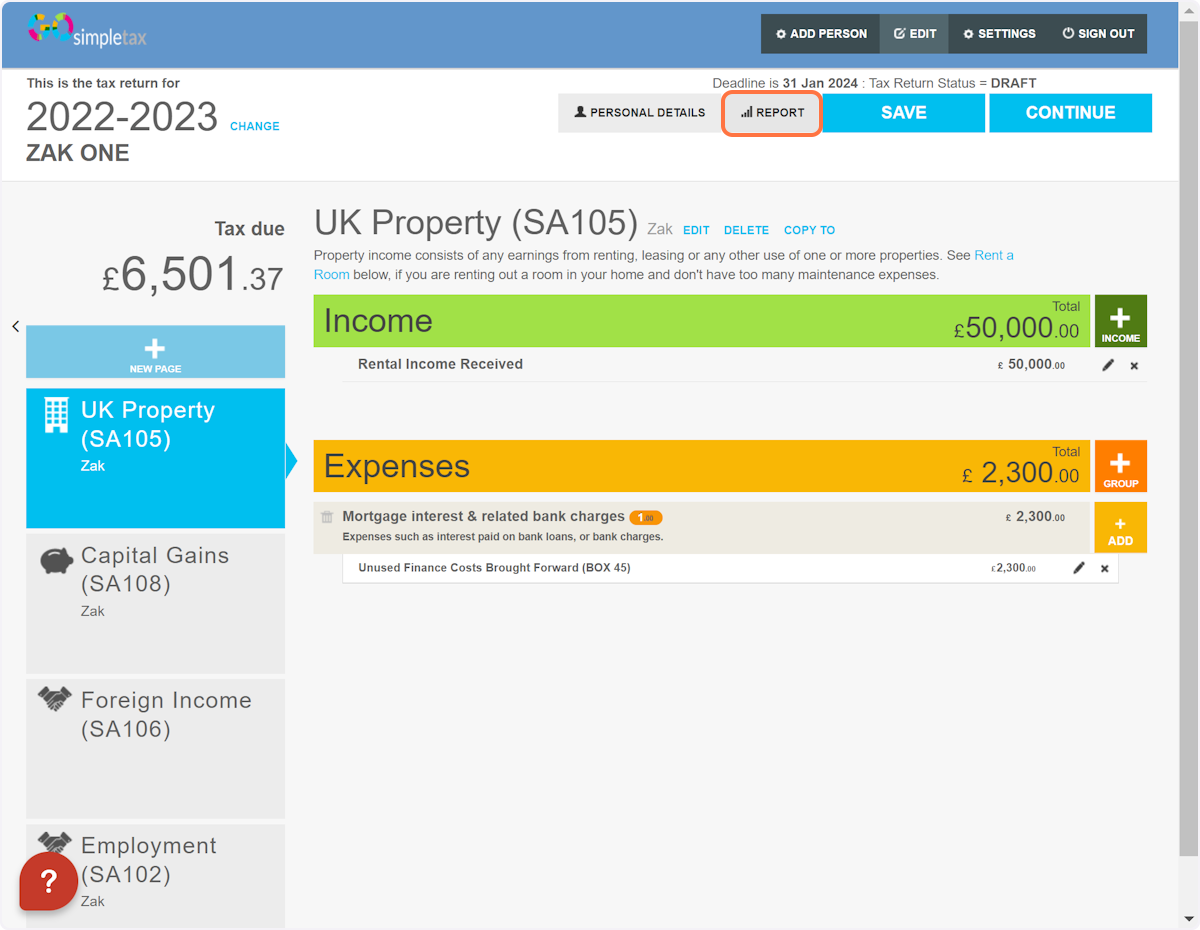

3. Click on '+ ADD'

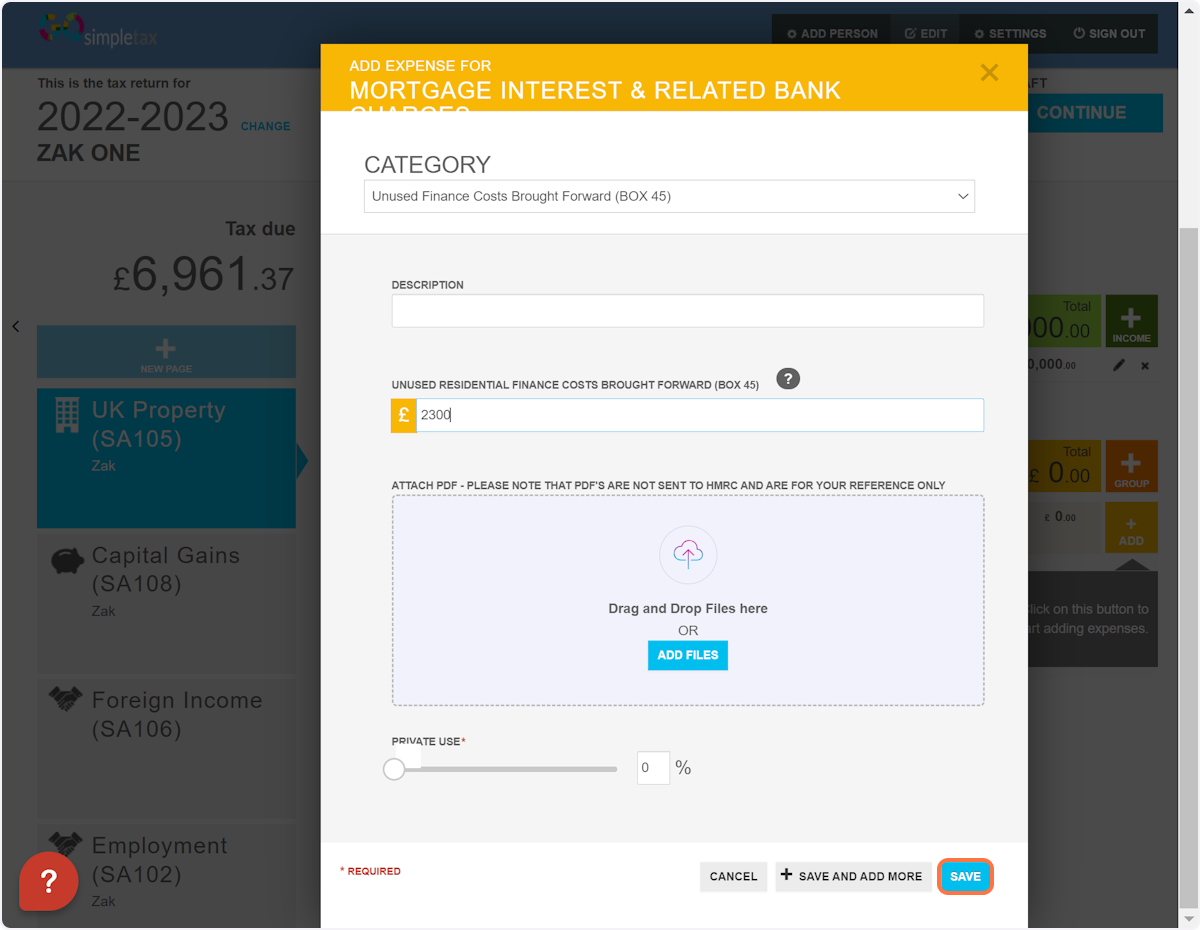

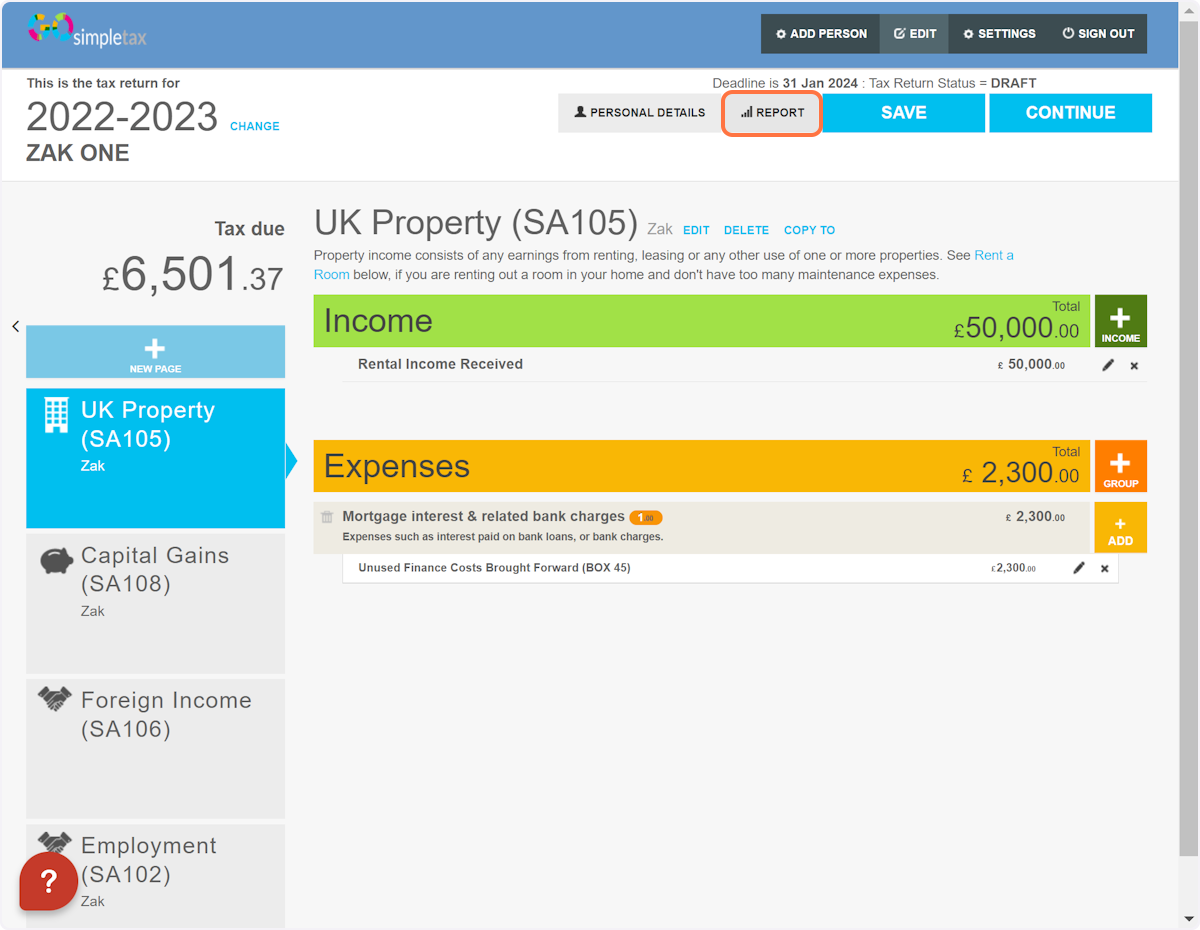

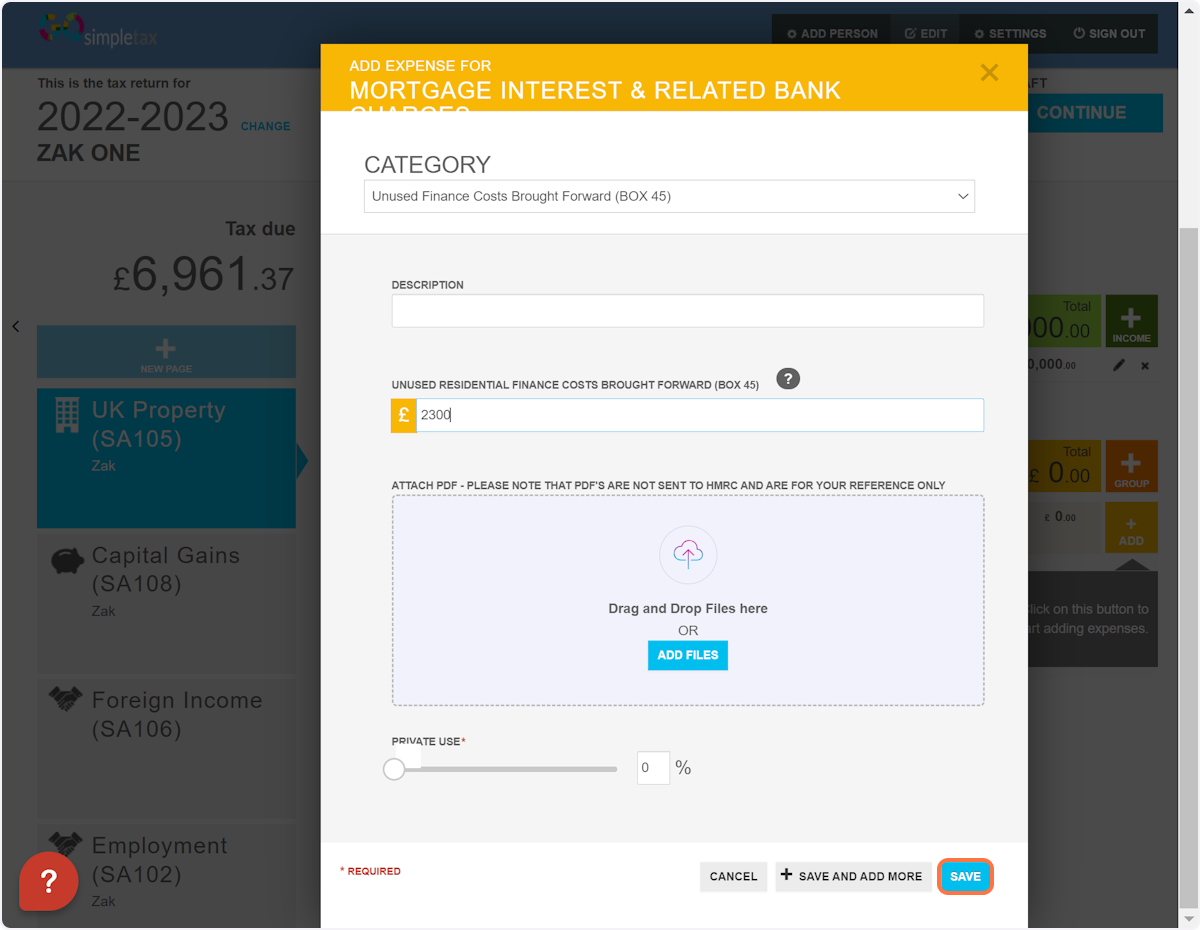

4. Select 'Unused Finance Costs Brought Forward (BOX 45)' from the drop-down list and enter the amount in the box provided below. Following this, click 'SAVE'

5. Click on 'REPORT'

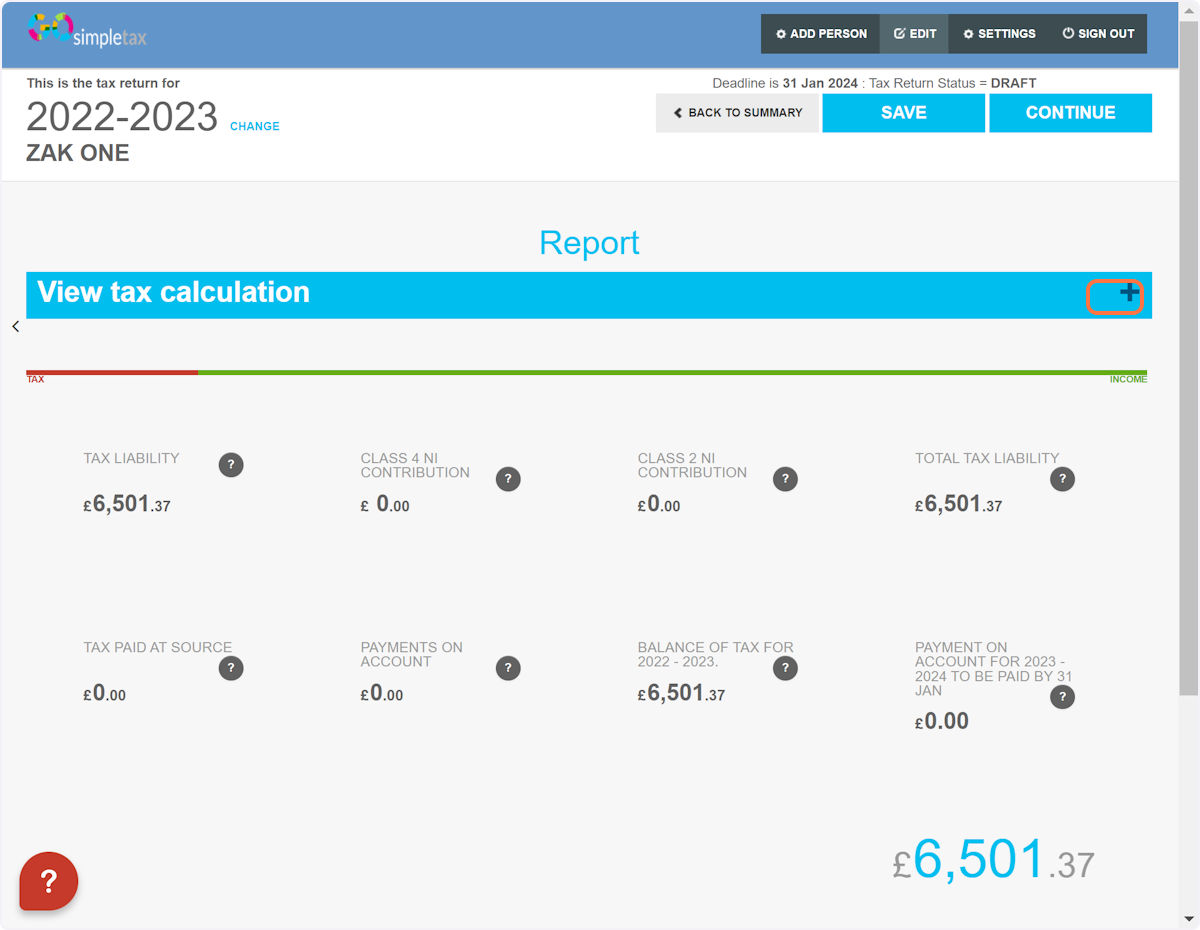

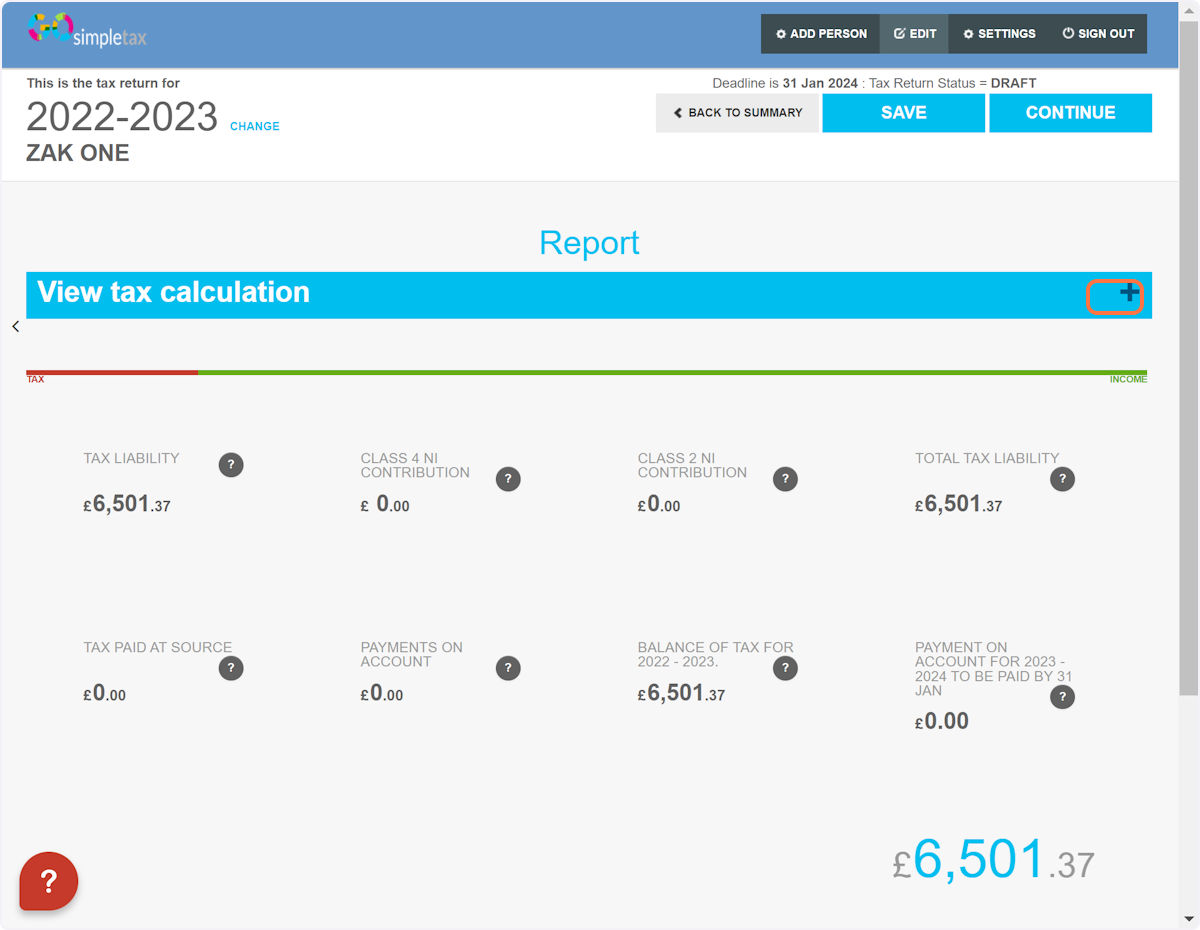

6. Click on the '+' symbol

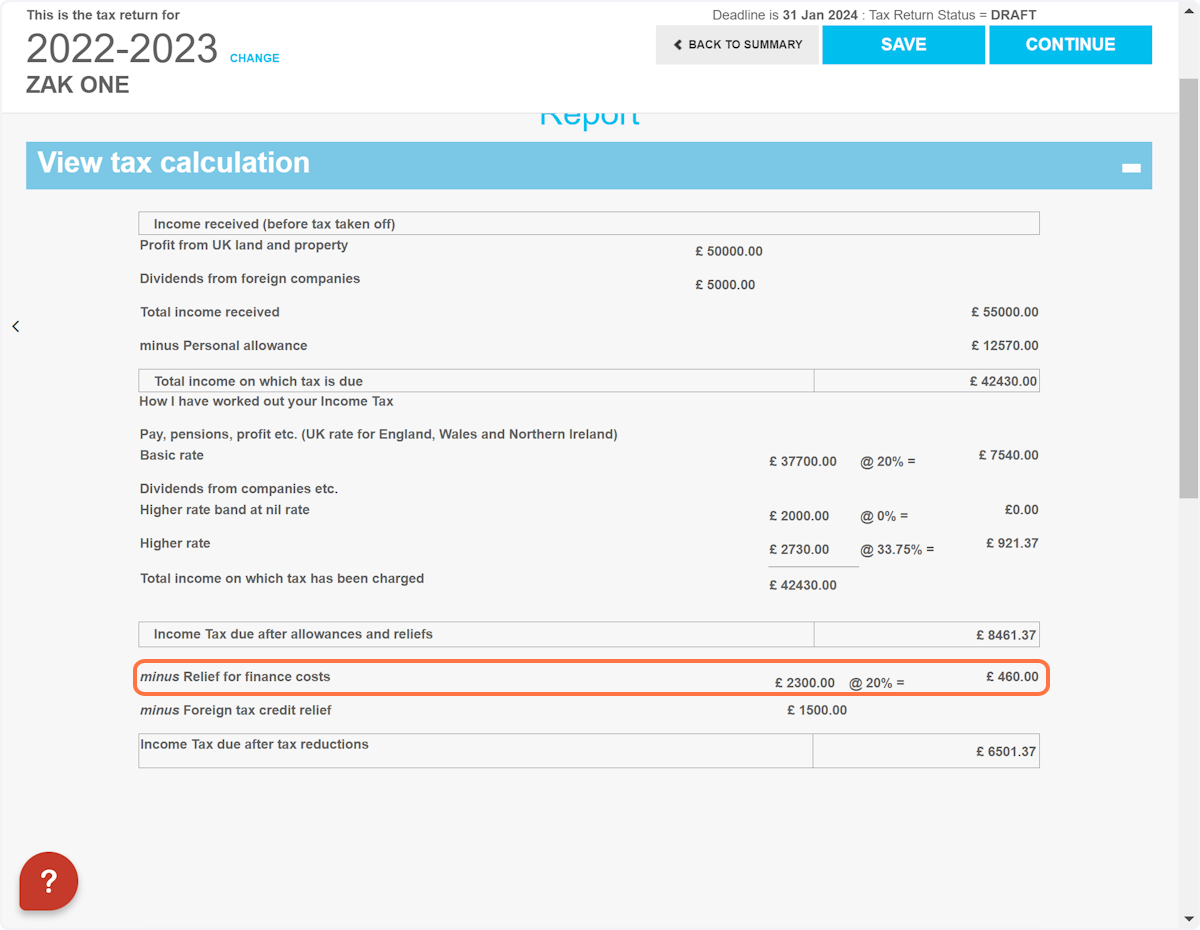

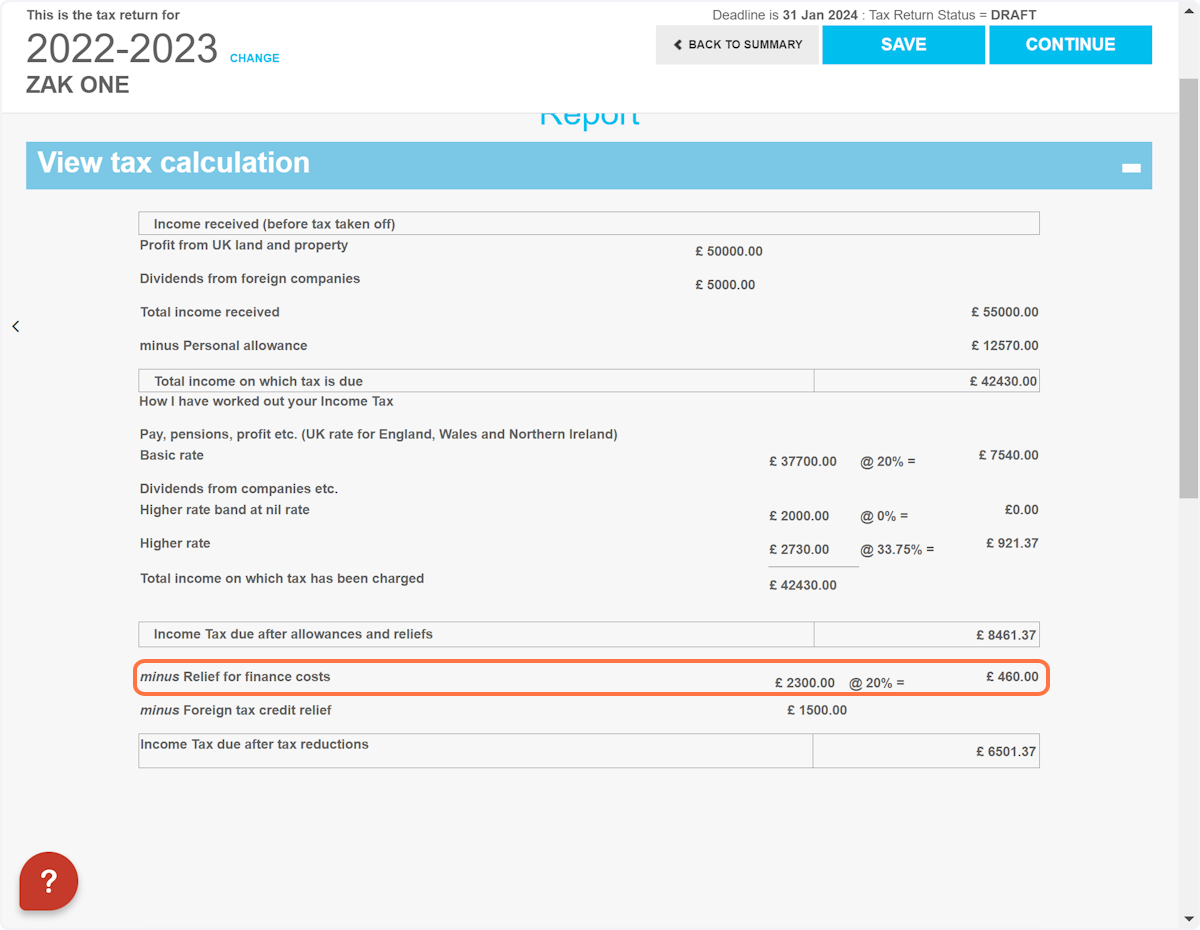

7. Here you'll find your unused finance costs brought forward being accounted for

Related Articles

SA106 : Residential Finance Costs: Property Abroad

For the tax year 6 April 2020 to 5 April 2021, the allowable costs of getting a loan or alternative finance to buy a residential property that is let ,plus any interest on those loans and alternative finance agreements is restricted to 0% of the ...

Partnership Property Finance Costs

For the 2020 to 2021 tax year, you can only claim 0% of the cost of getting a loan, or alternative finance to buy a residential property that you let, and 0% of any interest on such a loan or alternative finance payments. 1. Click on '+ NEW PAGE' and ...

SA107 : Estate Income: Restricted Finance costs

For the tax year 6 April 2019 to 5 April 2020, the allowable costs of getting a loan or alternative finance to buy a residential property that is let, and any interest on those loans and alternative finance, is restricted to 25% of these costs for ...

SA106 : Foreign Income: Residential Finance Costs

For the tax year 6 April 2020 to 5 April 2021, the allowable cost of getting a loan or alternative finance to buy a residential property that’s let, and any interest on those loans and alternative finance, is restricted to 0% of these costs for each ...

SA108: How to claim for brought forward losses

If you have b/f losses of £10,000 and you have gains of £12,300 and £2500, you would claim for the losses by following the instructions below: 1. Select the pencil icon for an entry 2. Select 'Yes' to the question regarding BOX 45, then enter the ...