SA101 : How do I add a chargeable event to my tax return?

If you have a chargeable event certificate and need to declare this on your tax return this is added as income on the Savings & Investments (SA100 & SA101) page.

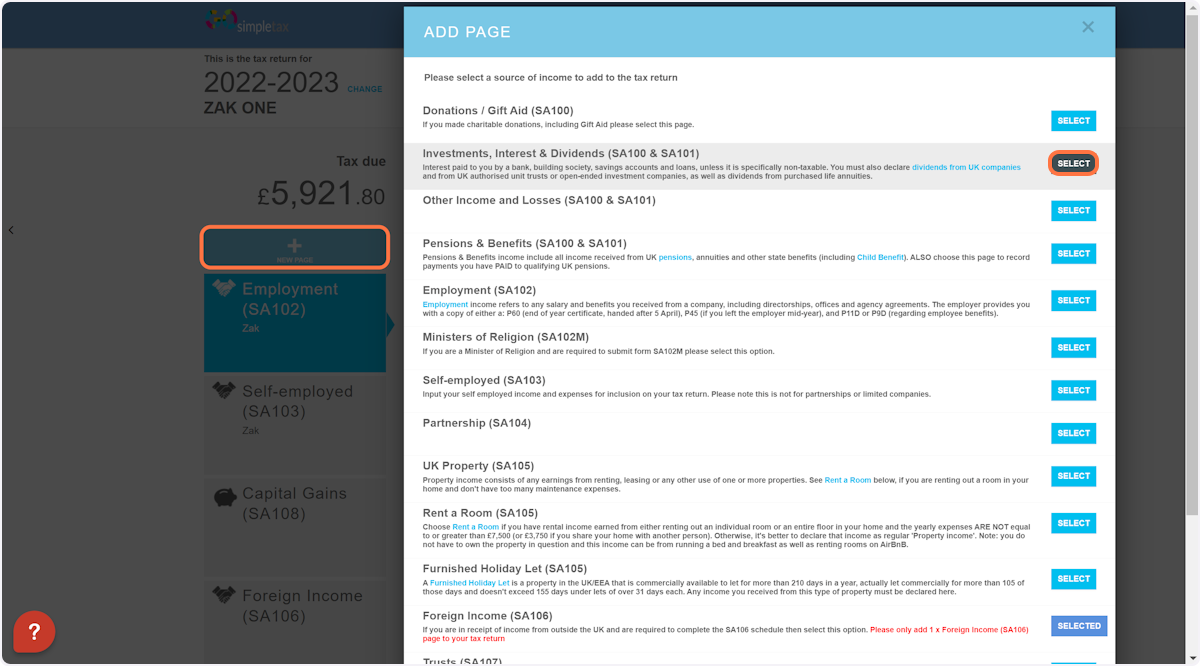

1. Click '+ NEW PAGE' and then select 'Investments, Interest & Dividends (SA100 & SA101)'

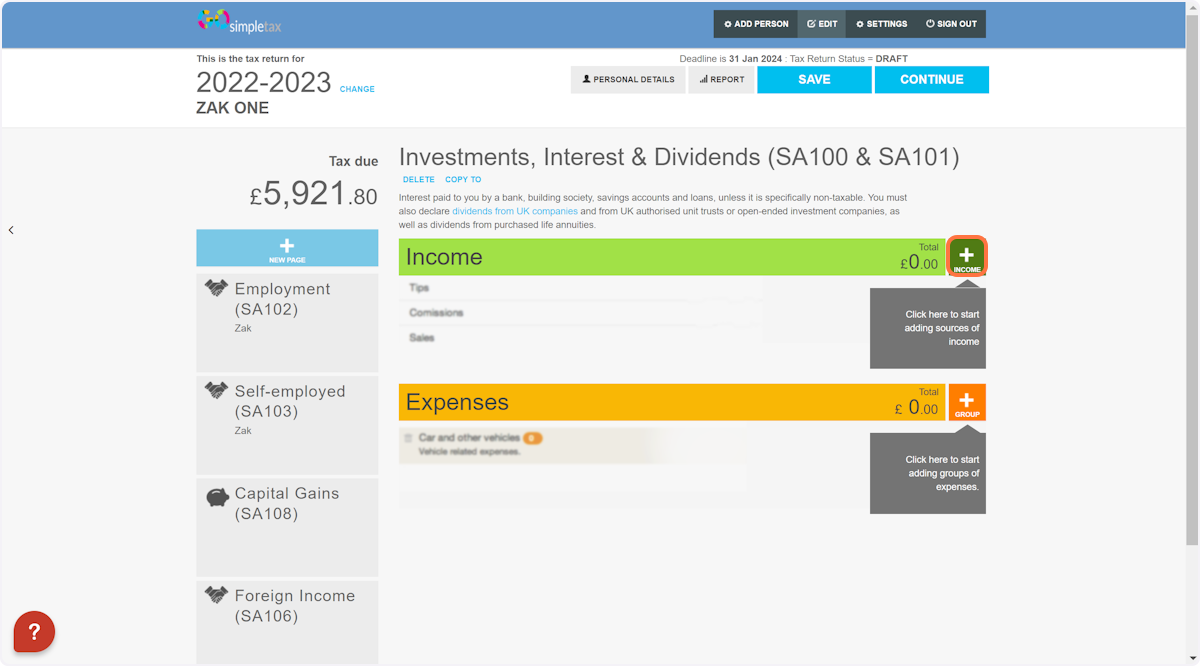

2. Click '+ INCOME'

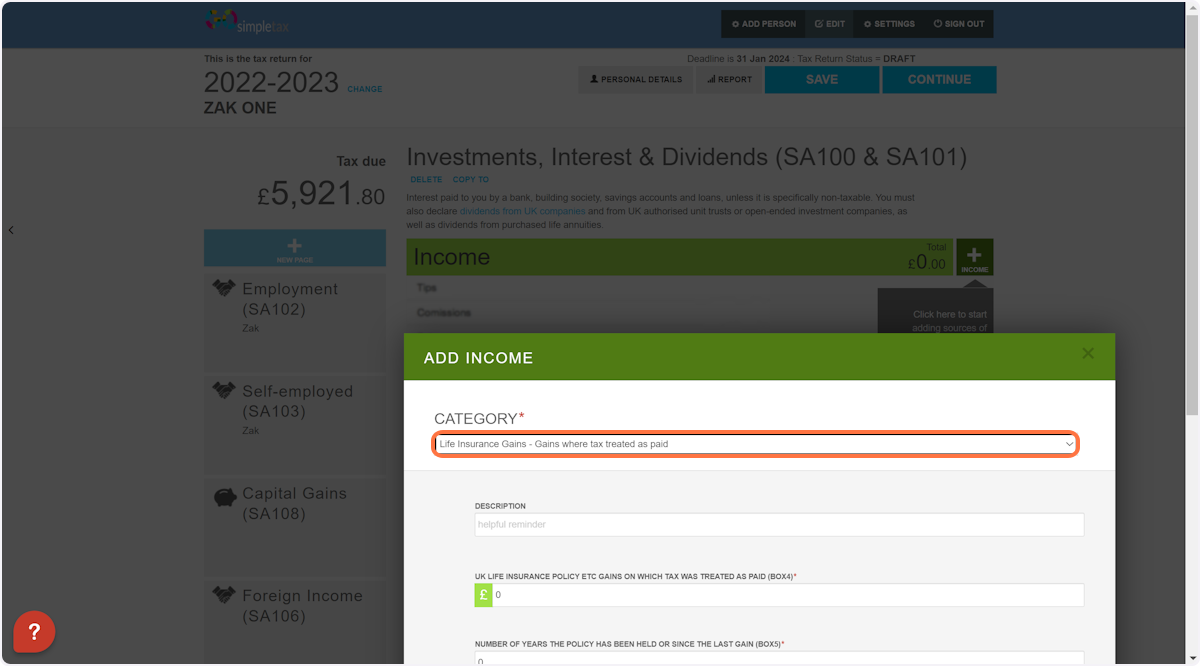

3. From the drop-down list of categories provided, please select one of the three life insurance options that apply to you.

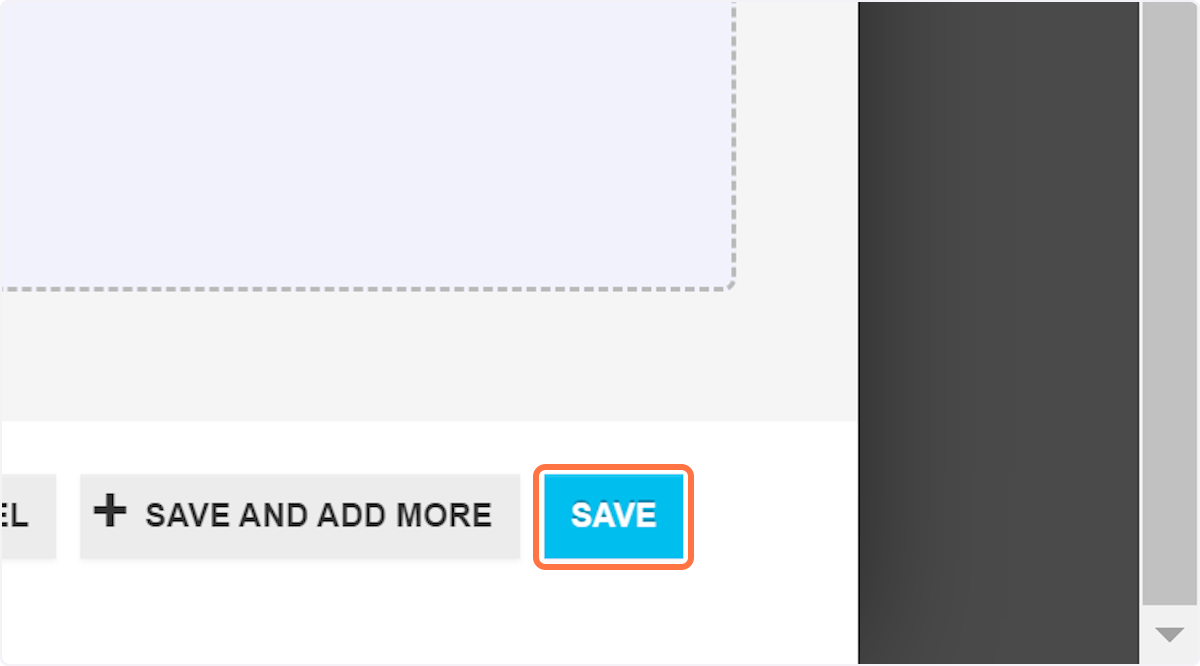

4. Fill in all required entries and then click 'SAVE' at the bottom

Related Articles

SA106: How do I enter Foreign life insurance gains?

To enter foreign life insurance gains on your tax return follow these steps: Please note, you should have received a chargeable event certificate which includes the details you need to enter. If you haven't received one then please contact your ...SA100 : Additional information BOX19 on TR7

You can add information into BOX 19 on TR7 on the Almost There! page. Please press SAVE & CONTINUE then YES You will then be taken to the ALMOST THERE page. Then, scroll down to the text box to enter additional information you would like HMRC to see ...How to add information into Box 54 in Capital Gains SA108

How to add information into Box 54 in Capital Gains SA108 1. Whilst under the 'Capital Gains (SA108)' tab, click 'EDIT' 2. Fill in the 'ADDITIONAL INFORMATION (BOX 54)' with whatever you require 3. Click 'SAVE' 4. Click on REPORT 5. Click on ...How to fill in BOX 40 (Additional Information) in Residency SA109

1. Click '+ NEW PAGE' located on the left of the screen and then scroll down until you see 'Residency (SA109)'. Select this option. 2. Scroll towards the bottom until you find 'Additional Information (Box 40)', then fill it in with any information ...SA100 TR 4 Box 8: How Do I Record Gift Aid payments made in the tax year?

To add gift aid please use the '+ new page' button on the left of the screen (Ignore this step if you already have the Donations/Gift aid page) Choose 'Donations / Gift aid' Press '+' to add a new expense group Tick 'Donations' and press 'Save' Press ...