SA101 : How do I add SEIS / EIS / VCT claims to my tax return?

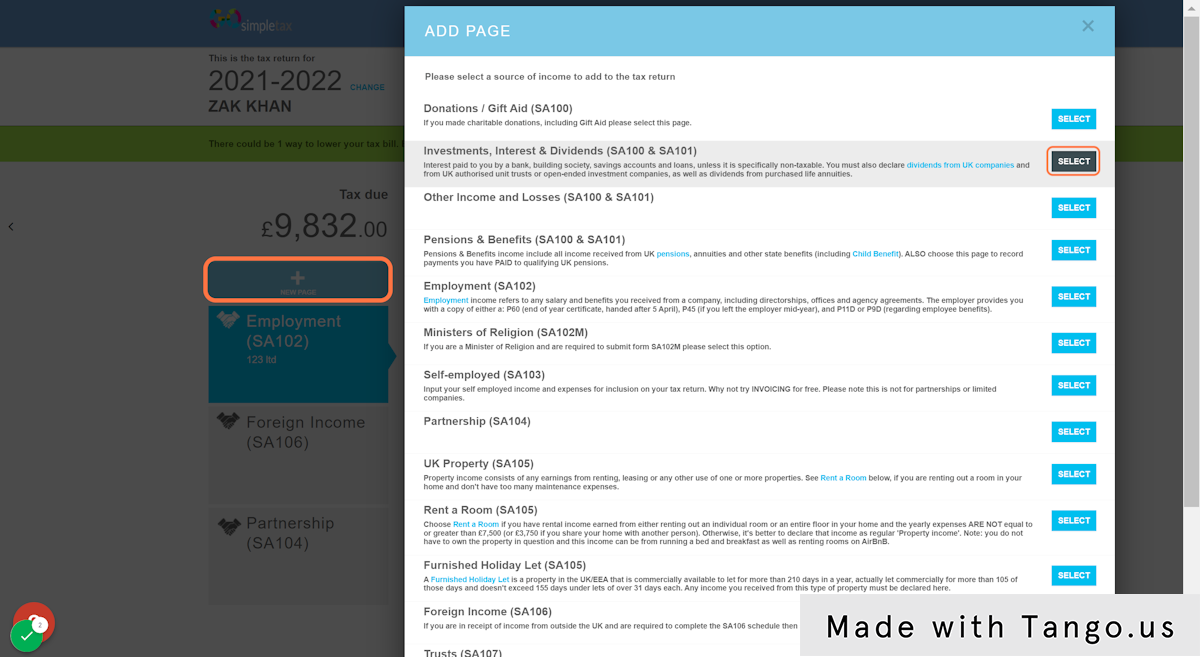

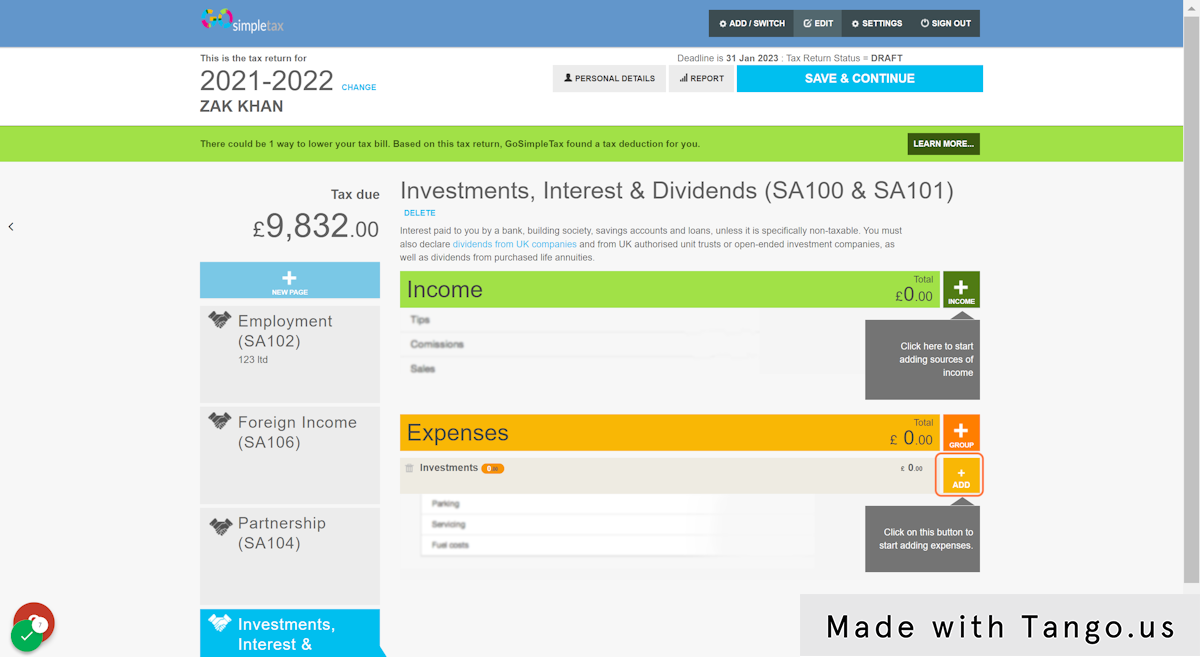

The claims for EIS / SEIS / VCT reliefs are made on the 'Investments, Interest & Dividends (SA100 & SA101)' page. If you have not already done so, please add this page:

1. Click '+ NEW PAGE' on the left hand side of the screen and then select 'Investments, Interest & Dividends (SA100 & SA101)'

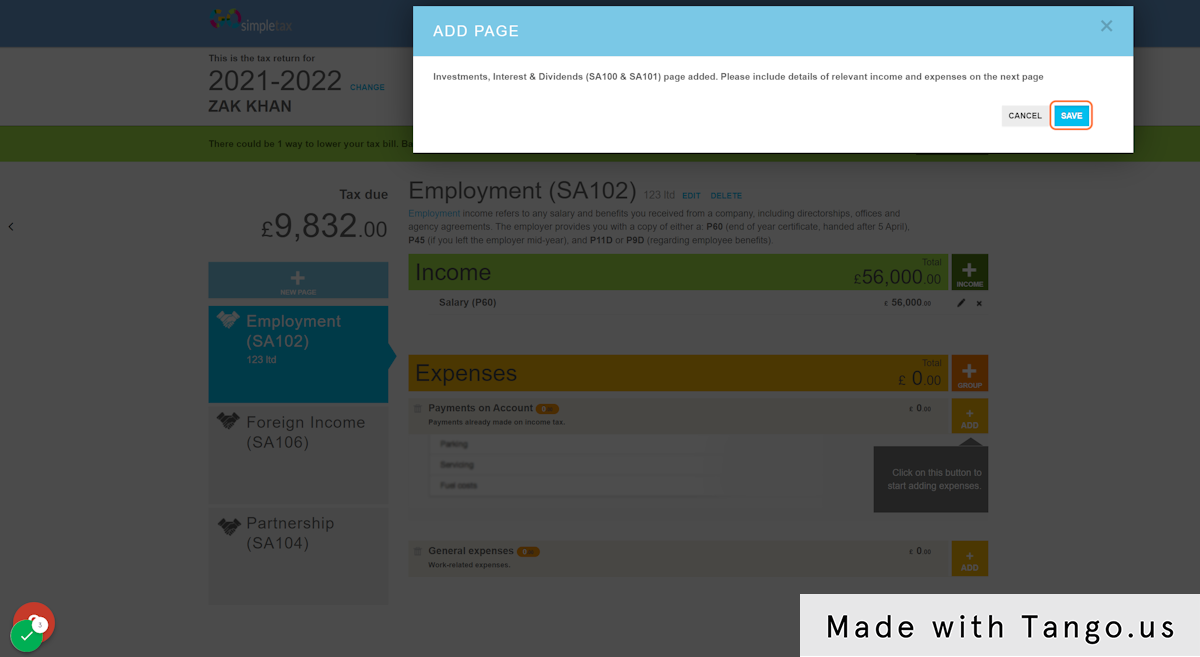

2. Click 'SAVE'

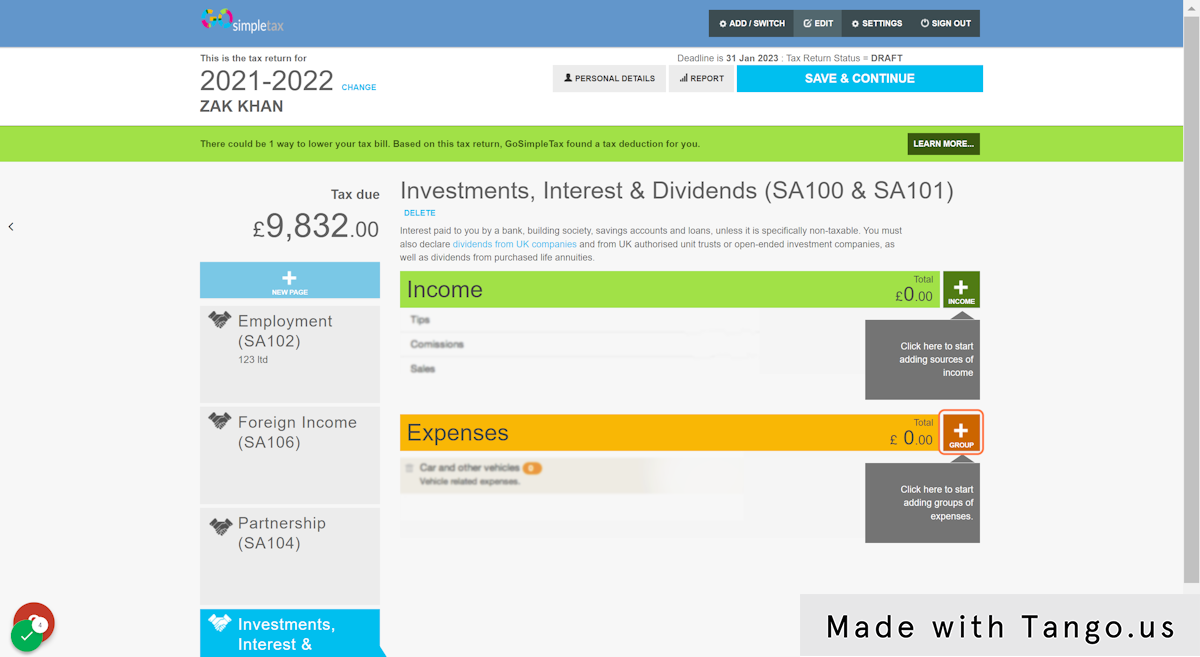

3. Click on '+ GROUP'

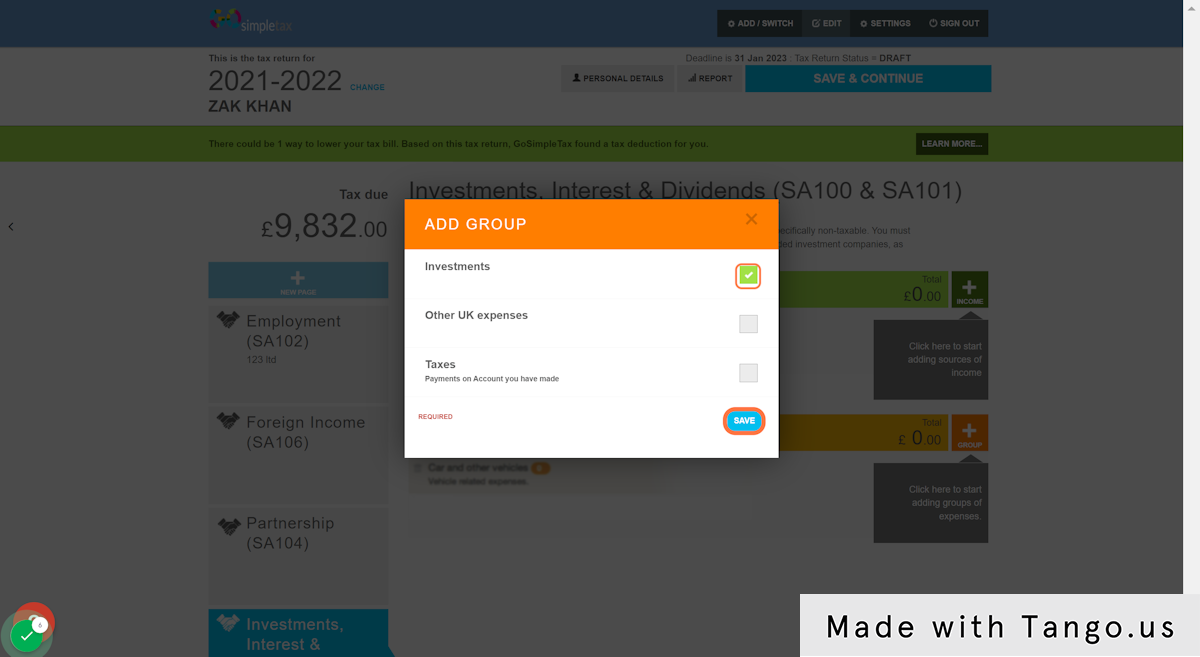

4. Select 'Investments' and then click 'SAVE'

5. Click on '+ ADD'

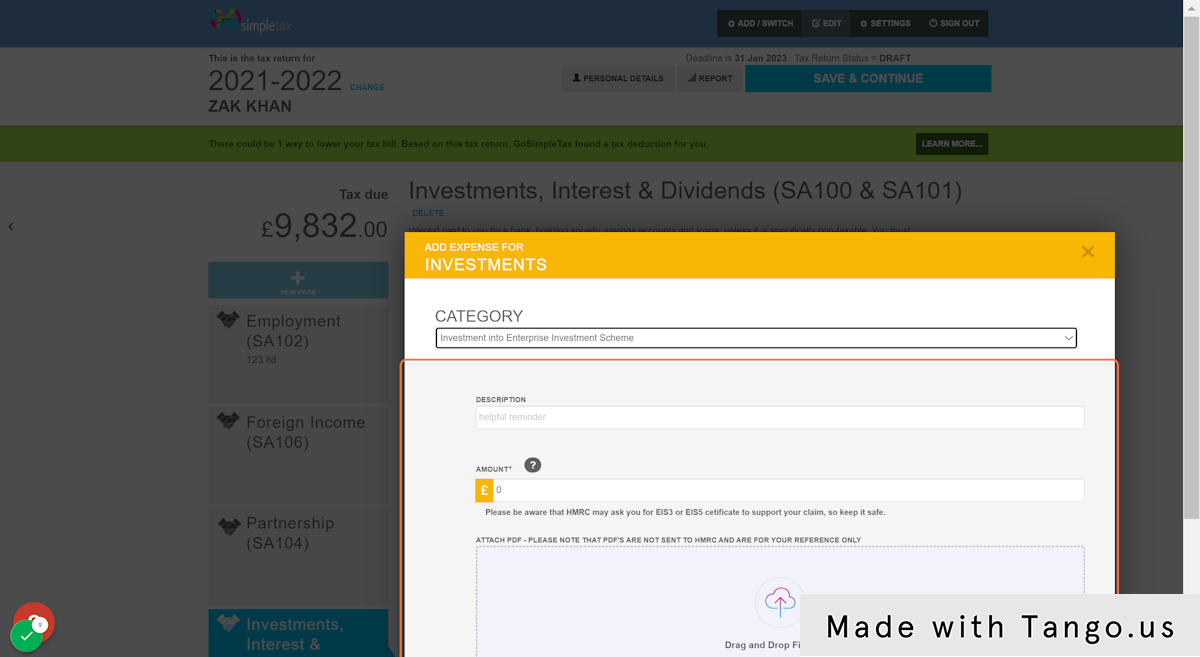

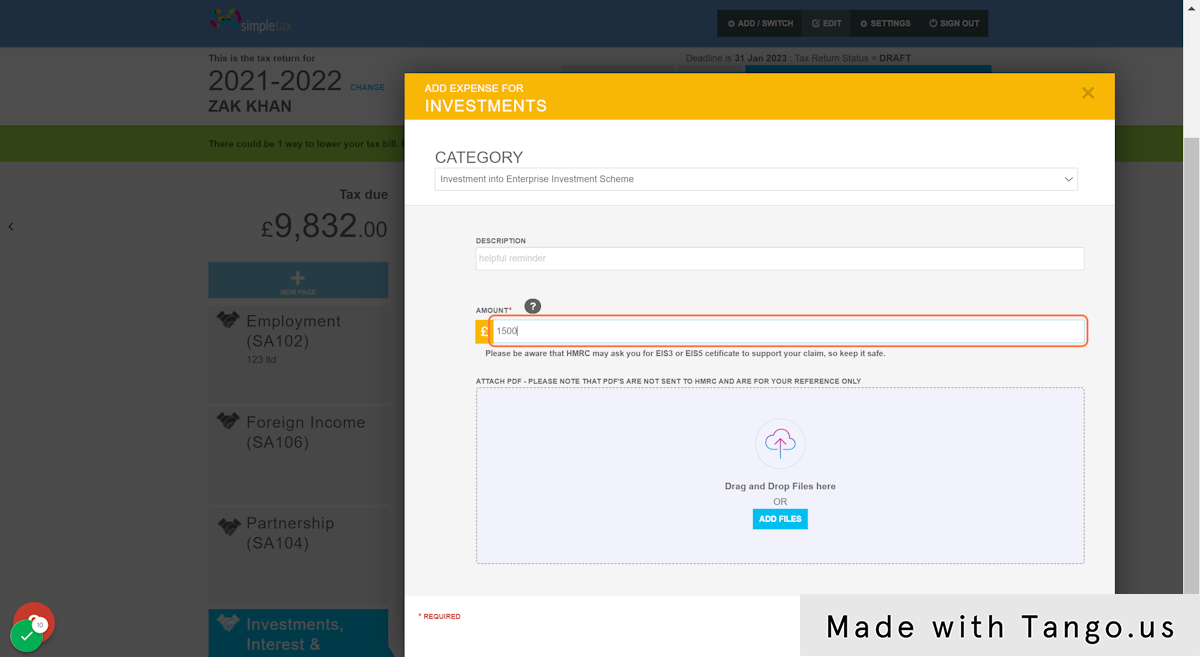

6. Select 'Investment into Enterprise Investment Scheme' from the drop-down list of categories

7. Enter the amount into the box highlighted and then click 'SAVE'

Related Articles

SA108: How to add EIS/SEIS loss relief

1. Click '+ NEW PAGE' and then select 'Capital Gains (SA108)' from the list of sources of income 2. Click '+ GAIN' and then select 'Unlisted shares and securities' from the drop-down list of categories. 3. Under the 'SALE' tab, enter the price you ...Getting started: How do I add a new page to my tax return?

How do you add a new schedule to my tax return? This can be achieved in three simple steps: 1. Press ‘NEW PAGE’ 2. Now ‘SELECT’ the relevant schedule 3. Then enter any requested details, where relevant, and press ‘SAVE’SA800 : How to add a Partnership Tax Return (SA800)

1. Once you have signed up, you'll be presented with this page. Scroll to the bottom until you see 'Partnership Tax Return (SA800)'. Then click the '+' symbol located on the right hand side, click 'Partnership Main' and then click 'Continue' 2. Fill ...Pension Tax Relief

Are you worried about your pension fund? Retirement is a daunting prospect, and saving for the future should always be a top priority. Today, SimpleTax will explain the basics about pension tax relief; how does it work and what are the limits? Today, ...SA109: NT tax code

If you have a NT code by way of DTA, you would need to complete the form HS302 or HS304 depending on your circumstance and attach that to your tax return on the SA109 page. If you read the instructions for either of the helpsheets, it will tell you ...