SA108: How to claim for brought forward losses

If you have b/f losses of £10,000 and you have gains of £12,300 and £2500, you would claim for the losses by following the instructions below:

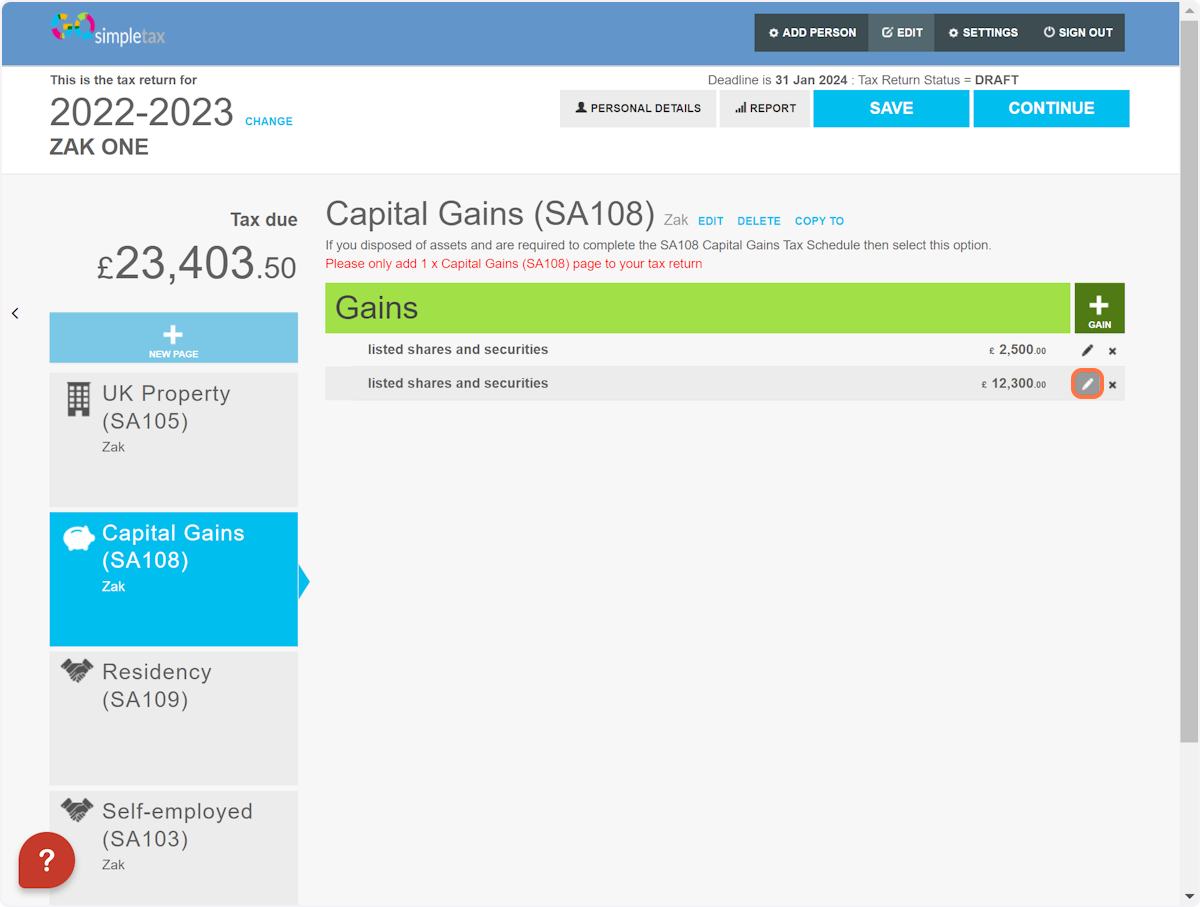

1. Select the pencil icon for an entry

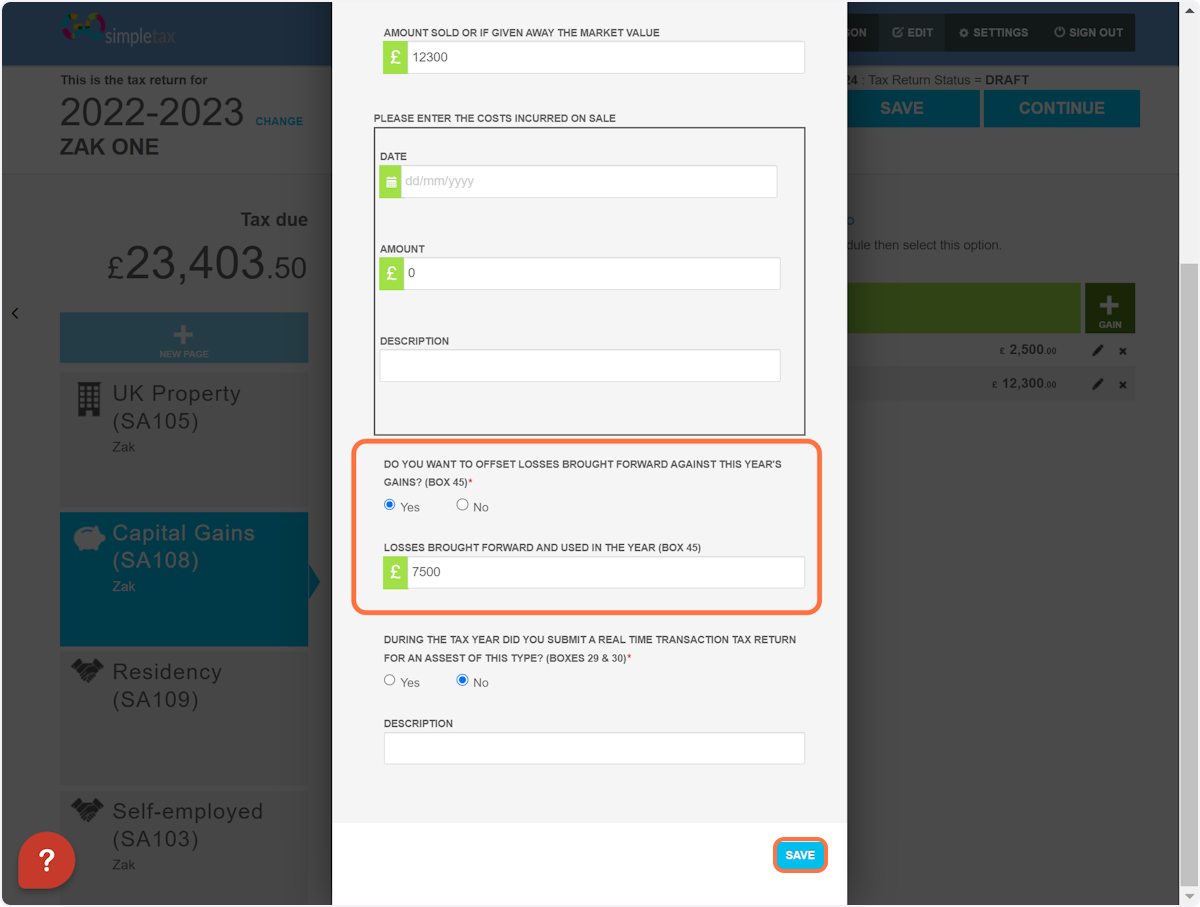

2. Select 'Yes' to the question regarding BOX 45, then enter the losses brought forward against this year's gains. Following this, click 'SAVE' at the bottom.

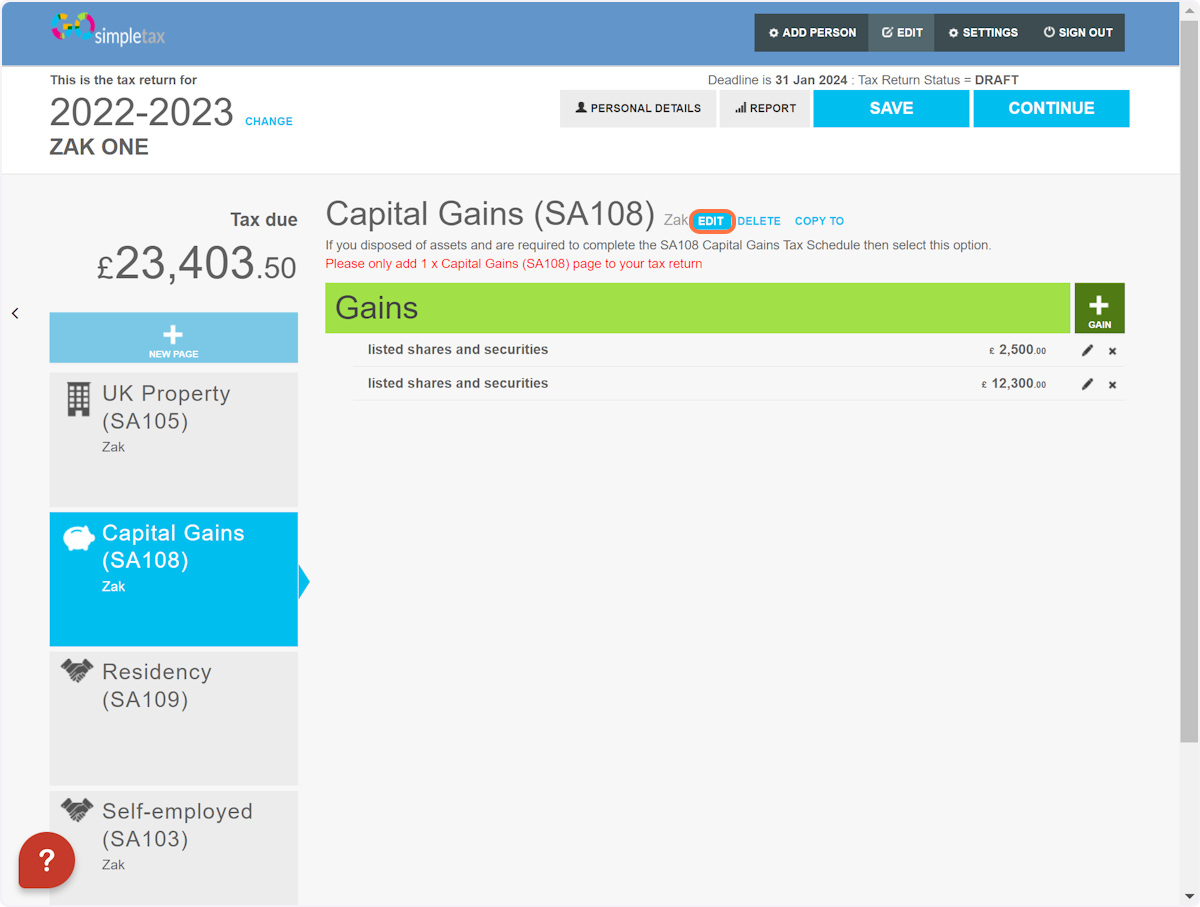

3. Click on 'EDIT'

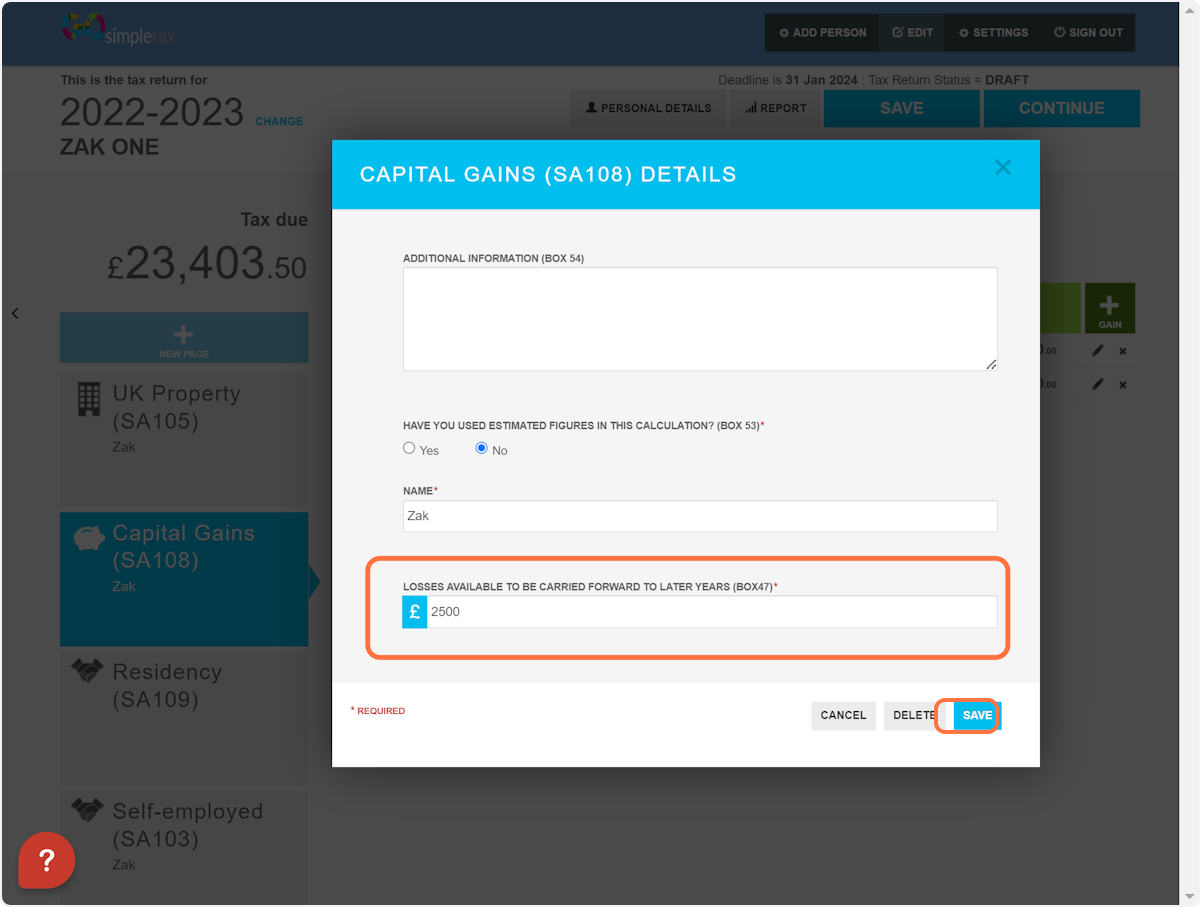

4. Enter the losses available to be carried forward to later years in the box provided, then click 'SAVE' at the bottom

As you have claimed £7500, you would have £2500 remaining to carry forward.

Related Articles

SA104 : How do I record Partnership Losses brought forward?

Click on the Partnership Page and click on EDIT Click on LOSSES and enter the VALUES Click SAVESA108: How do I carry losses forward to future years?

1. Once you're on the 'Capital Gains (SA108)' page, click 'EDIT' 2. Click on 'LOSSES AVAILABLE TO BE CARRIED FORWARD TO LATER YEARS (BOX47)' and fill in the box. Following this, click 'SAVE' at the bottom.How to enter capital losses brought forward and losses made in the current year

1) Click 'EDIT' once on the 'Almost there' page 2) Fill in tthe box stating 'Losses available to be carried forward to later years (Box 47)' 3) Click 'SAVE'SA108 : How do I record Losses Carried Forward on Capital Gains?

Click on the Capital Gains Page Click on EDIT Enter the AMOUNT Click SaveSA108 : Can I set off income losses against Gains?

Put the amount of any allowable trading losses that you want to set against chargeable gains in box 16. This should be the lower of: • the total losses you can claim • the amount required (after setting off capital losses for the year) to reduce the ...