How to download my tax return

If you've already filed your tax return or want to access one that's been submitted in the past, skip to step 3.

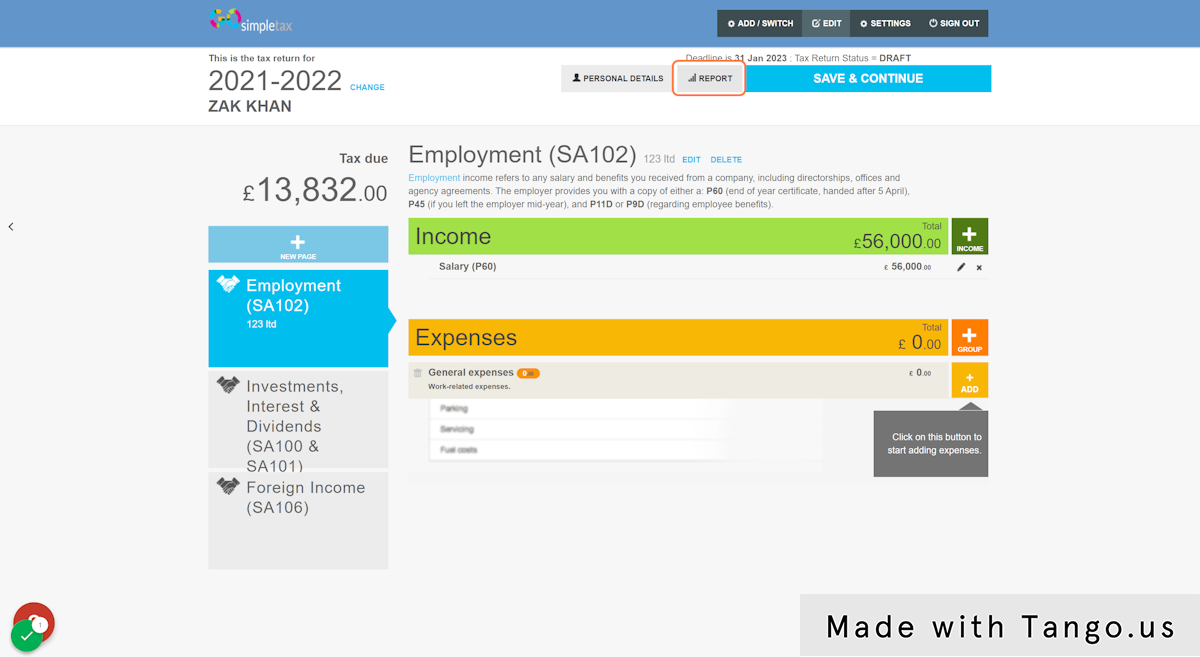

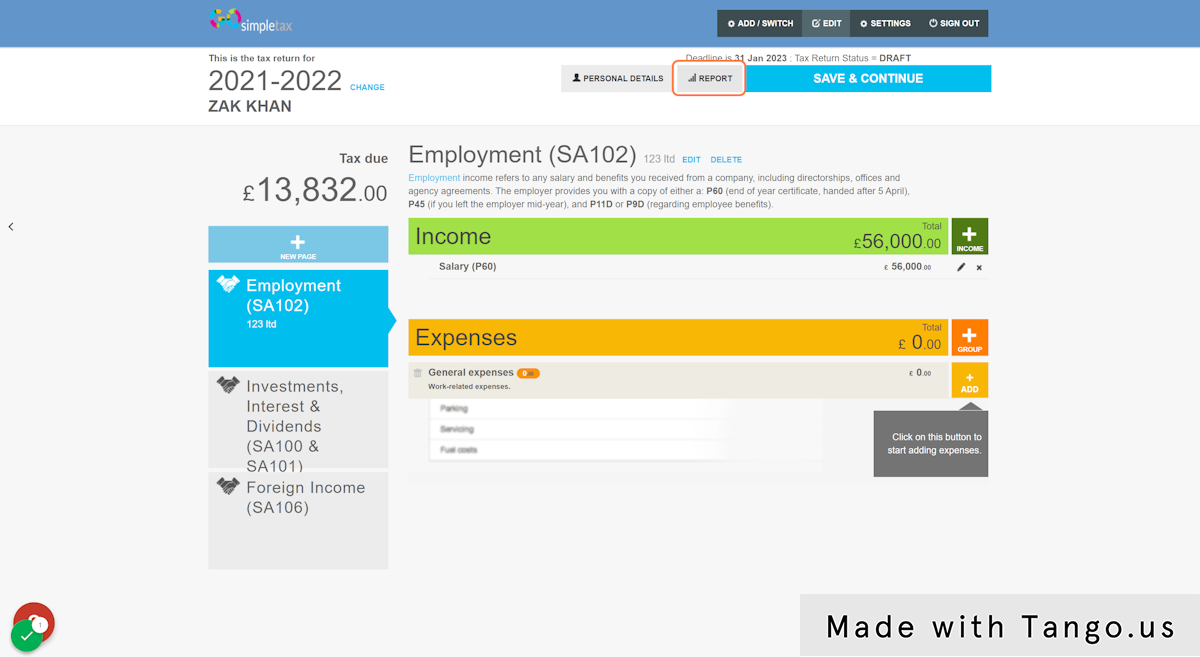

1. Click on 'REPORT' located towards the top of the screen

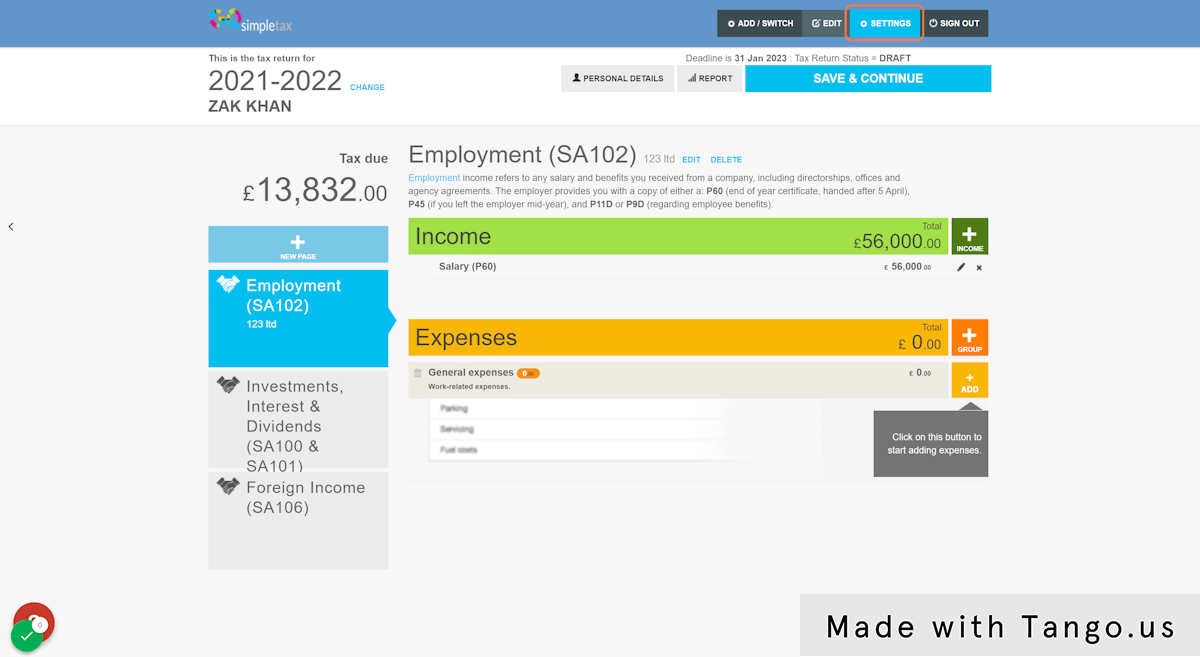

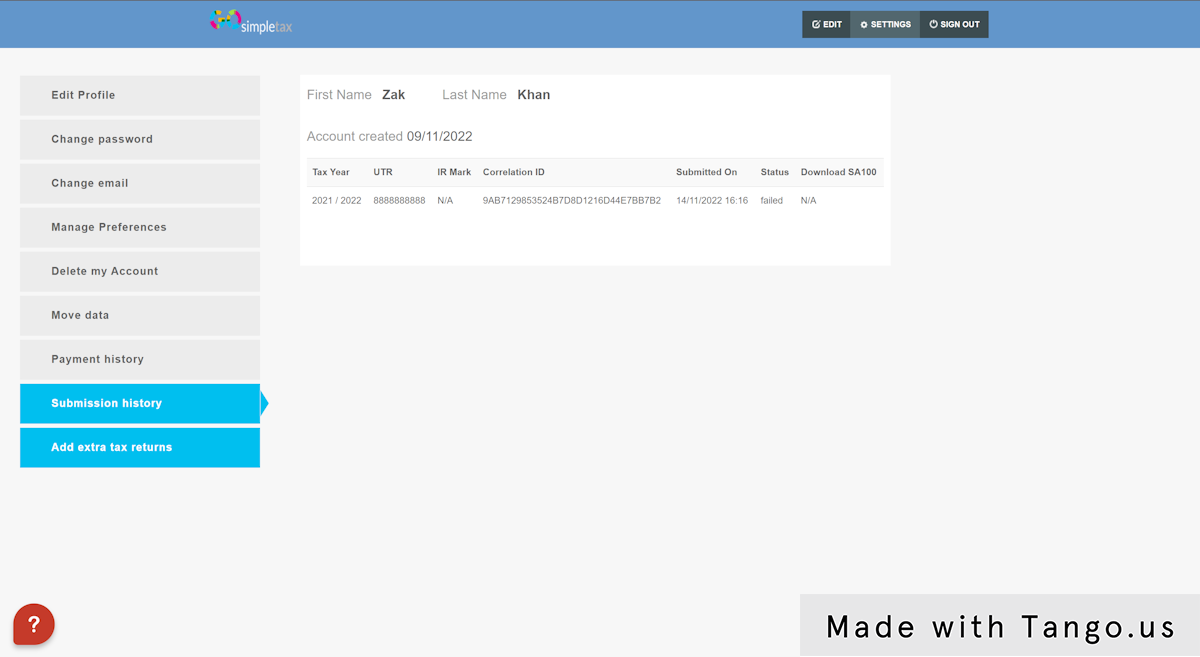

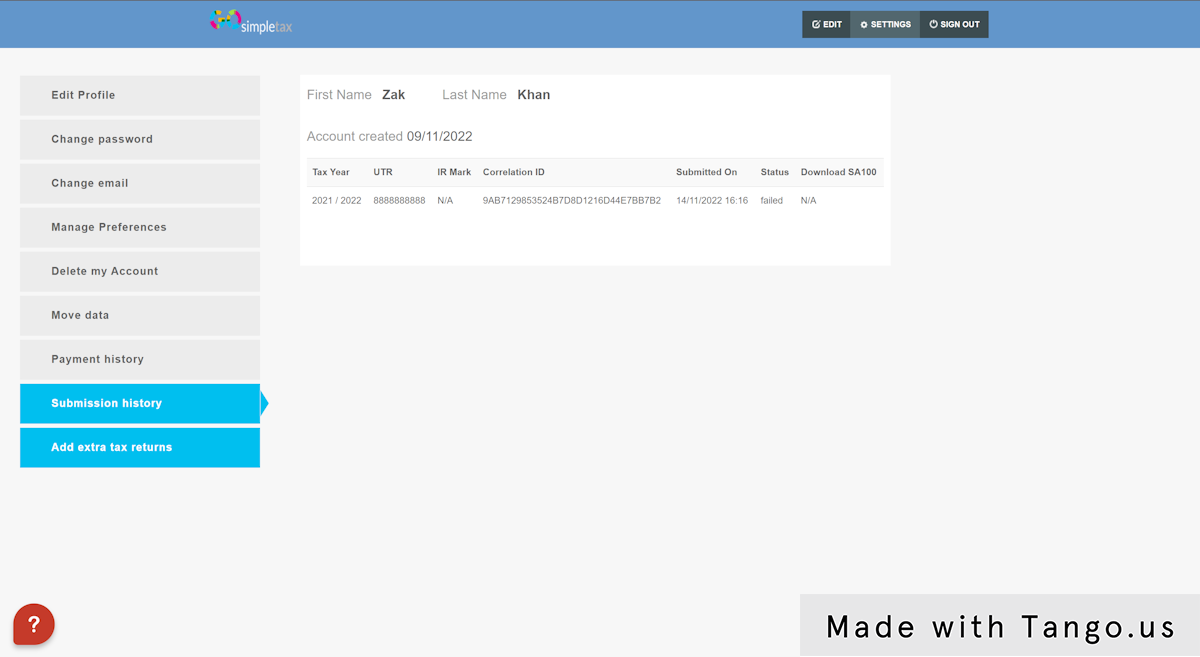

4. Click on 'Submission history' and you'll be able to download any tax returns which you have filed previously to HMRC (through GoSimpleTax)

Related Articles

What Are The UK Tax Year Dates And Filing Deadlines

The tax year runs from the 6th April - 5th April. Your accounts need to be calculated according to these dates. You can start submitting your tax return on the first day of the next tax year 6th April. 31 October is the deadline for paper filing of ...

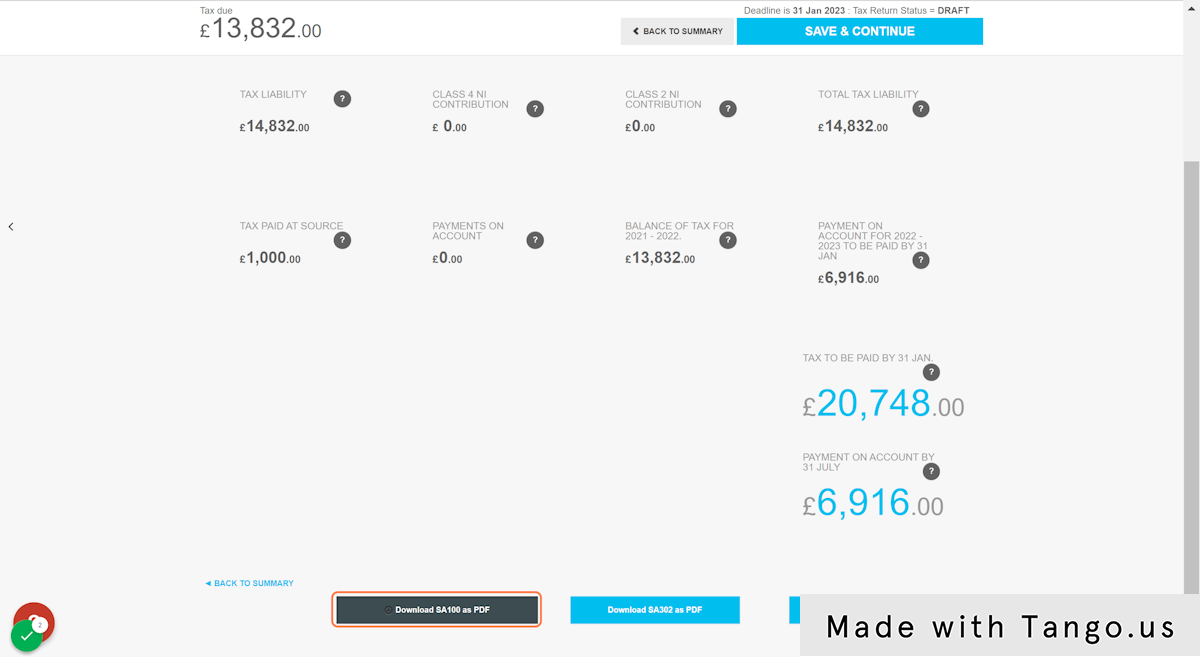

How to download my tax calculation

1. Click on 'REPORT' located towards the top of the screen 2. If you just want to view your tax calculation, click the '+' symbol which has been highlighted below 3. Once you've clicked the '+', you will see the tax calculation for all of your ...

How do I get a UTR ?

What is a Unique Taxpayer Reference? A Unique Taxpayer Reference (UTR) is a 10-digit number issued by HMRC that uniquely identifies individual taxpayers or businesses for tax purposes. It is essential for submitting tax returns or communicating with ...

How do I submit my Self Assessment?

*Please note you will require a HMRC login in order to successfully submit your return Click VALIDATE MY TAX RETURN or SAVE & CONTINUE Click YES to proceed Select Yes or No in all the Relevant Radio Button Options, please be sure to scroll down the ...

How do I add self assessment to my Gateway account

Whilst you may have created a Government Gateway account and have a UTR, it may be that your Self Assessment account and Gateway accounts have not been linked. If they are not linked, you will not be able to file your Self Assessment tax return. To ...