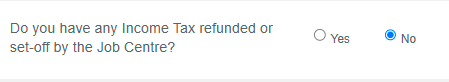

SA100 : Income tax refunded or set off by job centre

Income Tax Refunded goes on the ALMOST THERE PAGE

Click on SAVE & CONTINUE

Click on YES to proceed

see image below - answer YES and enter the amount

Click on REVIEW CALC and proceed to save changes

To go back to the main page click on EDIT

Click on SAVE & CONTINUE

Click on YES to proceed

see image below - answer YES and enter the amount

Click on REVIEW CALC and proceed to save changes

To go back to the main page click on EDIT

Related Articles

SA100 : I have income tax refunded in the year, how do I add this to my tax return?

This may be a repayment of CIS deductions (if you work in the construction industry), PAYE tax or tax paid on savings income. It may also be an amount reallocated by HMRC to an existing debt. When you are ready to file your TAX RETURN Click SAVE & ...SA100 : Business Receipts Taxed as income in earlier year

If, after your business ceased, you received any business receipts that need taxing as income of an earlier year, put you can report this by following the steps below Click on the Investments, Interest and Dividends Page. You can add this by ...Getting started: How to change tax year

On the left hand side of the page you will see the current tax year you are in. Press CHANGE and select the UPDATE/SWITCH button next to the tax year you wish to access. Please see the screen recording on the following link for visual demonstration: ...Navigation: How to get to the 'Almost there' page?

Press CONTINUE at the top of the page: Then press YES: # This will being you to what we call the 'Almost there' page which contains additional questions which may be relevant to your tax return:SA109: How do I claim split year treatment?

How do I claim split year treatment? To include split year treatment claim on your tax return, follow the instructions below. Please note, you should pay attention to the other questions on this page not covered in this guide, these are different for ...