SA101 : Pension Savings Tax Charges

Box 11.1 SA101 Ai4

This is for UK Registered Pension Schemes.

Your pension scheme administrator should have given you the information you need to fill in this box

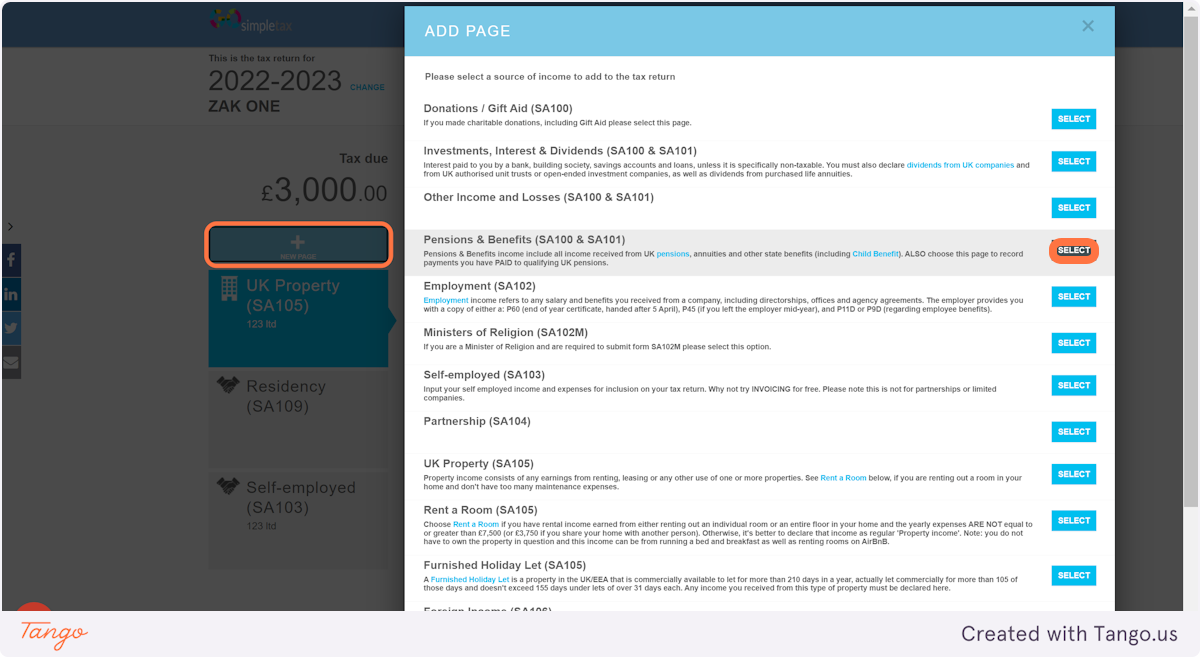

1. Click '+ NEW PAGE' and then select 'Pension & Benefits (SA100 & SA101)'

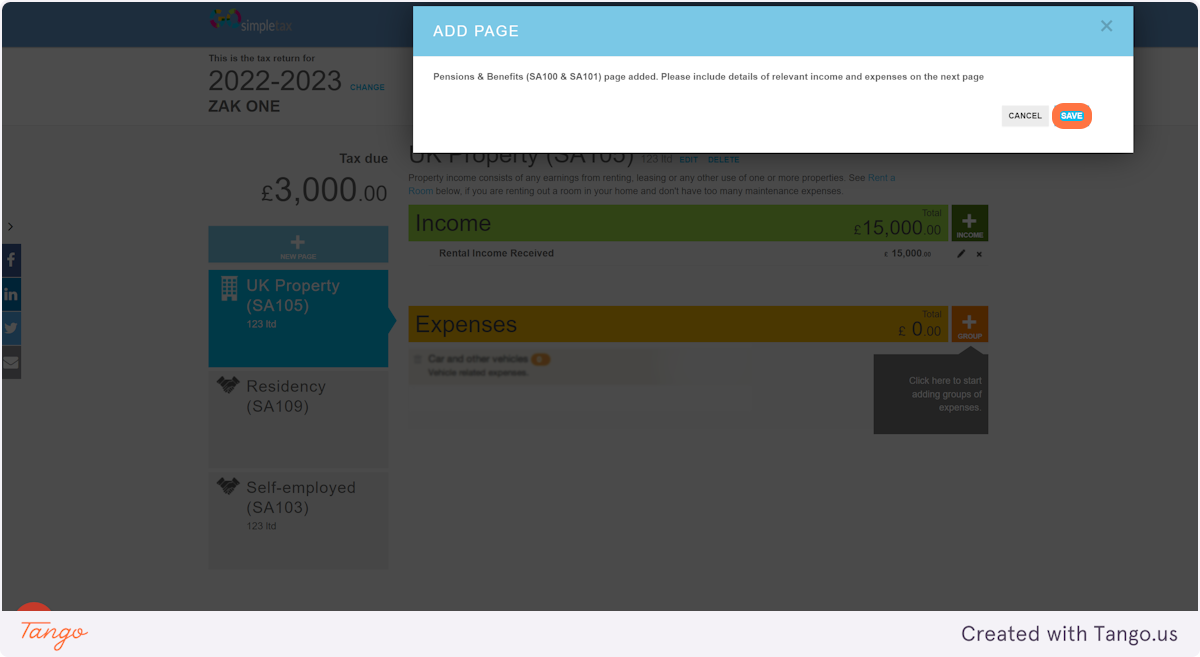

2. Click 'SAVE'

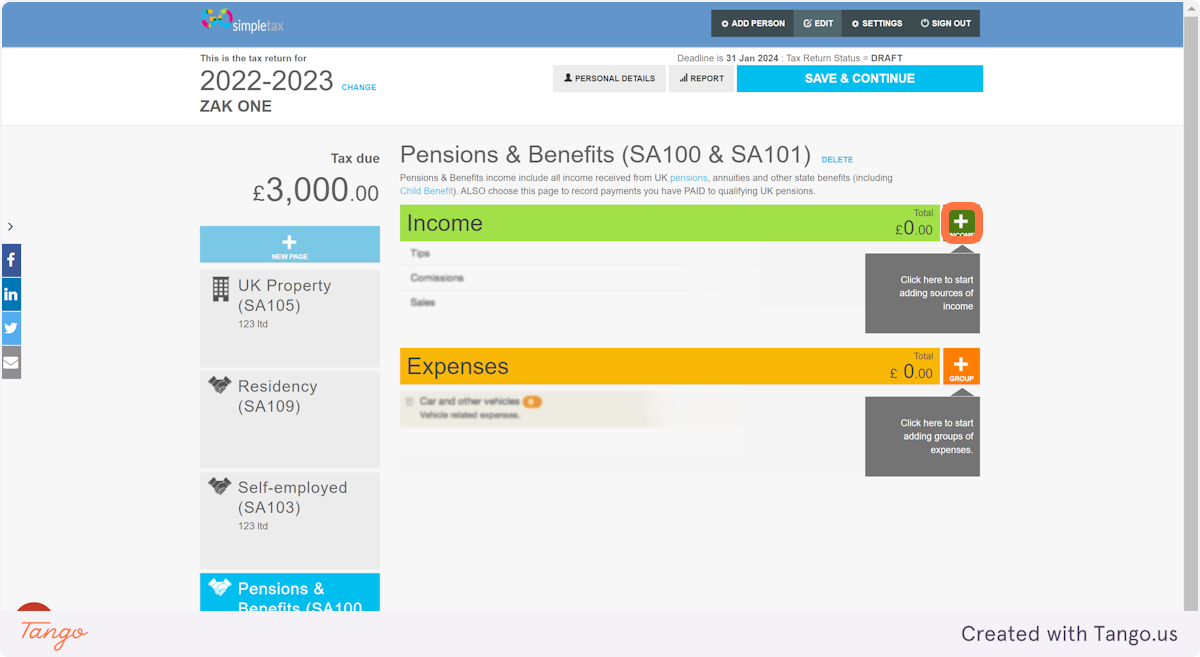

3. Click on '+ INCOME'

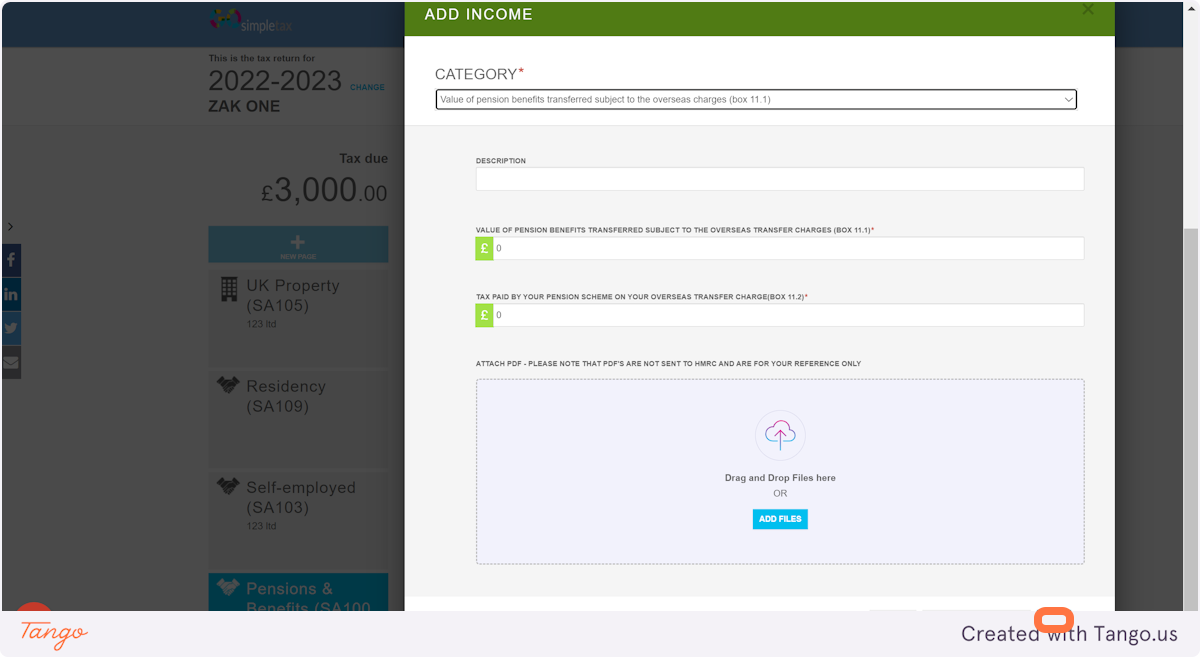

4. Select 'Value of pension benefits transferred subject to the overseas charges (box 11.1)' from the drop down menu, fill in the boxes provided and then click 'SAVE' at the bottom

Related Articles

Pension Tax Relief

Are you worried about your pension fund? Retirement is a daunting prospect, and saving for the future should always be a top priority. Today, SimpleTax will explain the basics about pension tax relief; how does it work and what are the limits? Today, ...SA102 : Personal Pension for Employment

Select the Employment Page Click Add Group Expenses Tick Pension Click Save Click on Add Pension From the drop down list select 'Payments to a 'relief at source' registered pension scheme' or 'Payments with no tax relief received', whichever is more ...SA102 : Where do I record my employment pension contributions?

1. Click '+ NEW PAGE' and then select 'Employment (SA102)' from the list of options provided 2. Click on '+ GROUP' on the right hand side of the page 3. Select the category labelled 'Pension' then click 'SAVE' 4. Click on '+ ADD' 5. Select ...SA104 Box 29: How do I show an Adjustment to untaxed savings income including adjustment for the tax year?

If you have not yet added the Partnership Page, please see the video below for guidance: Watch a video here Click on ADD NEW PAGE and select SA104 Partnership Next, click the Pen icon where it says 'Untaxed savings income': Enter the figure in the ...SA100 TR 4 Box 1: How Do I Record payments into Registered Pension Schemes?

Click on '+ New Page' on the left hand side of the screen (ignore this step if you already have the Pensions & Benefits page added to your tax return and skip to the drop down menu list) Select 'Pensions & Benefits (SA100 & SA101)' Select + GROUP ...