SA100 & SA101: How do I add UK unit trust income?

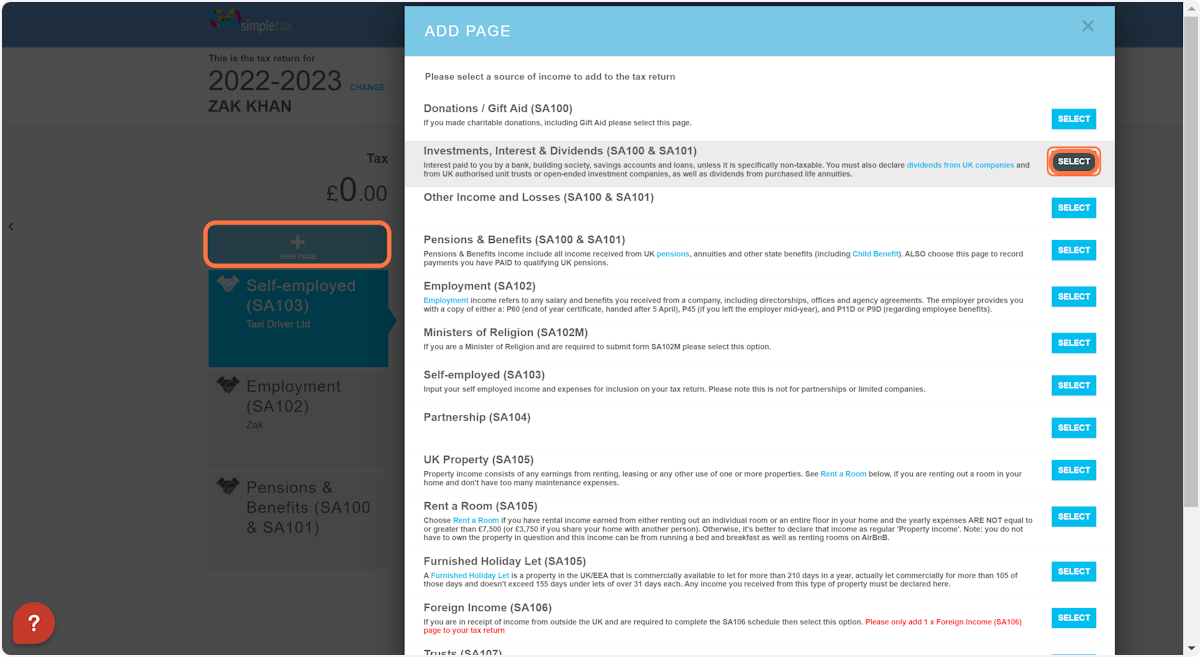

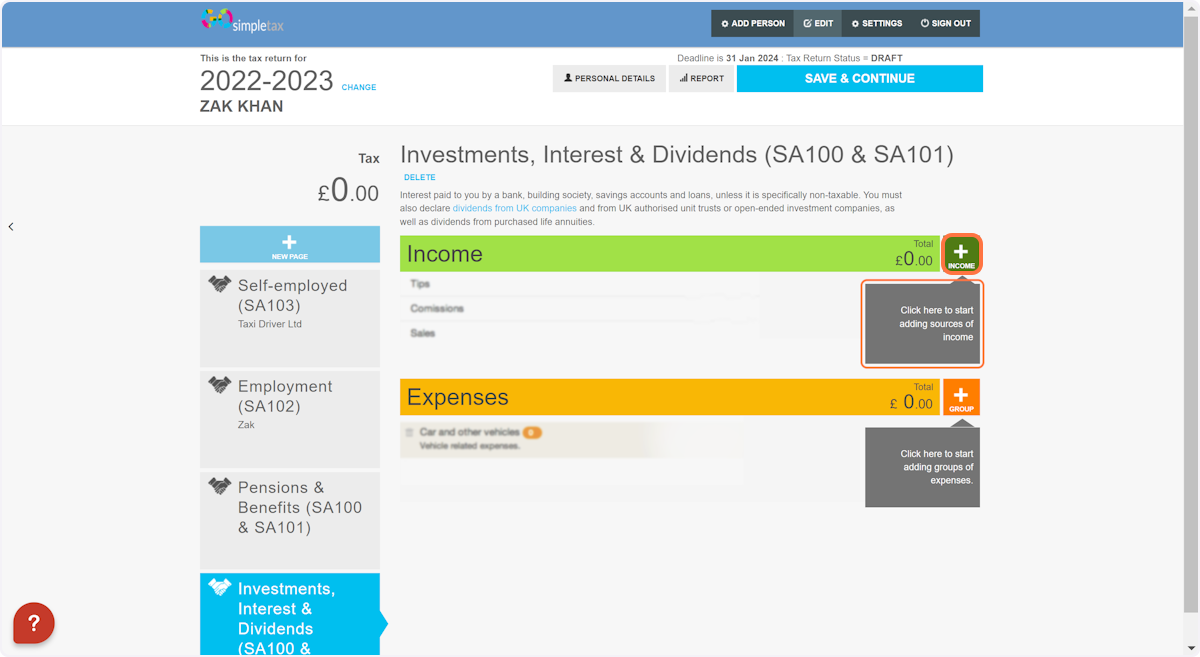

1. Click on '+ NEW PAGE', then select 'Investments, Interest & Dividends (SA100 & SA101)'

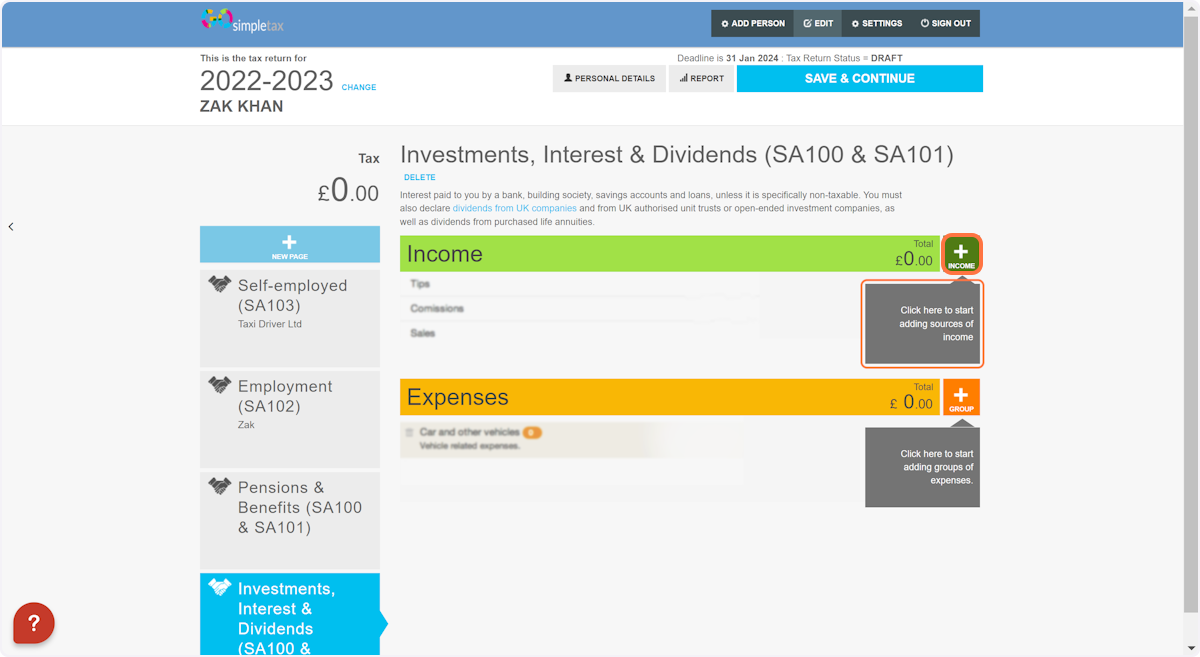

2. Click on '+ INCOME'

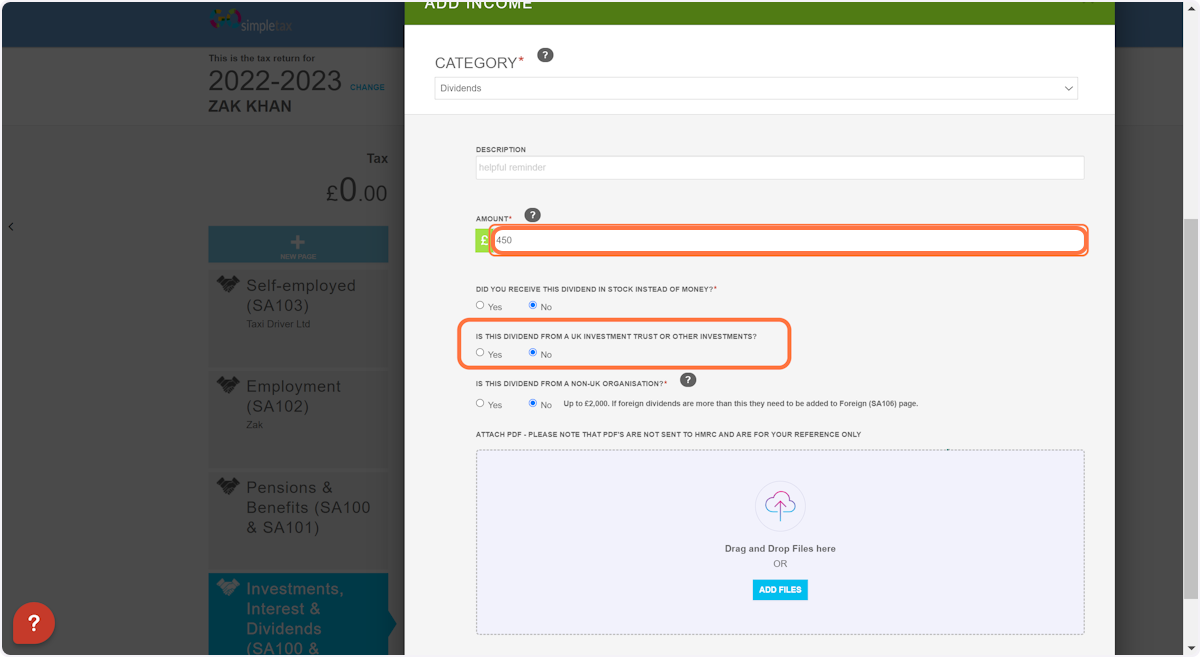

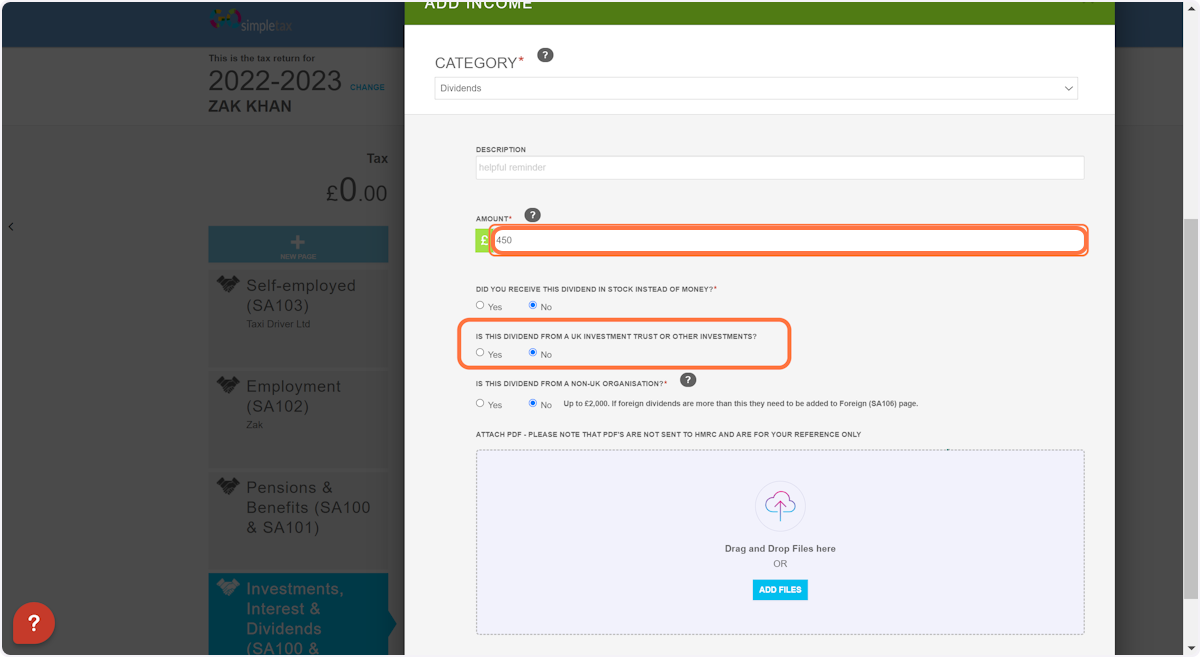

3. Select 'Dividends' from the down-down list provided, then enter the amount you'd like to declare. Select 'Yes' for the question 'Is this dividend from UK investment trust or other investments?'

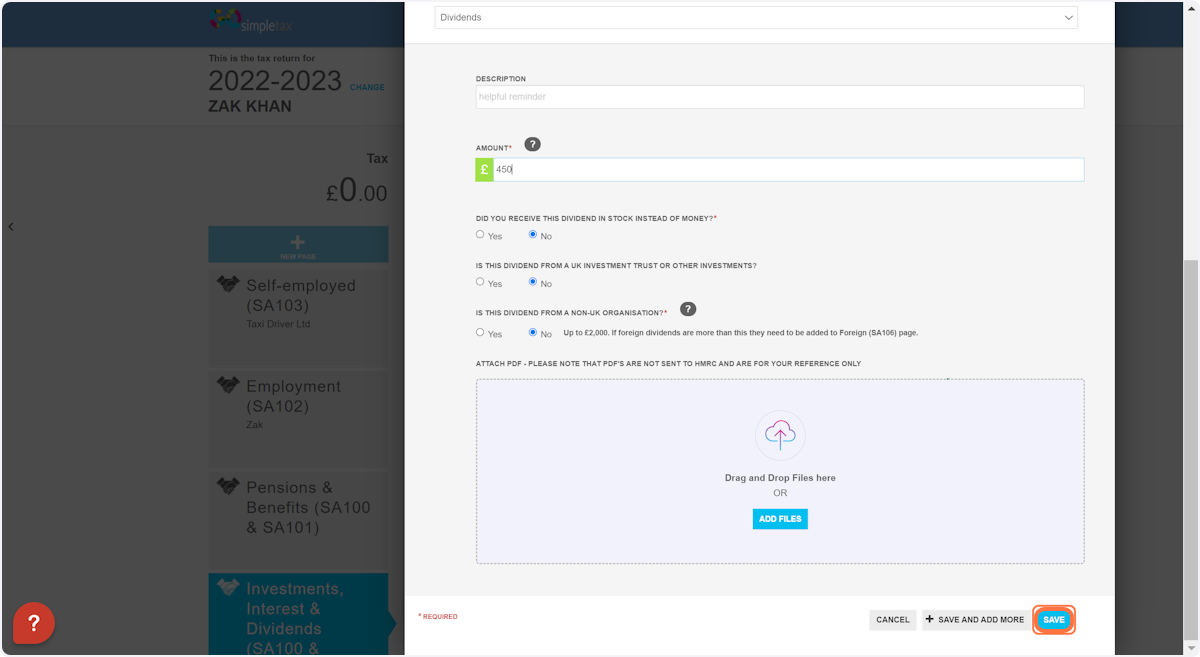

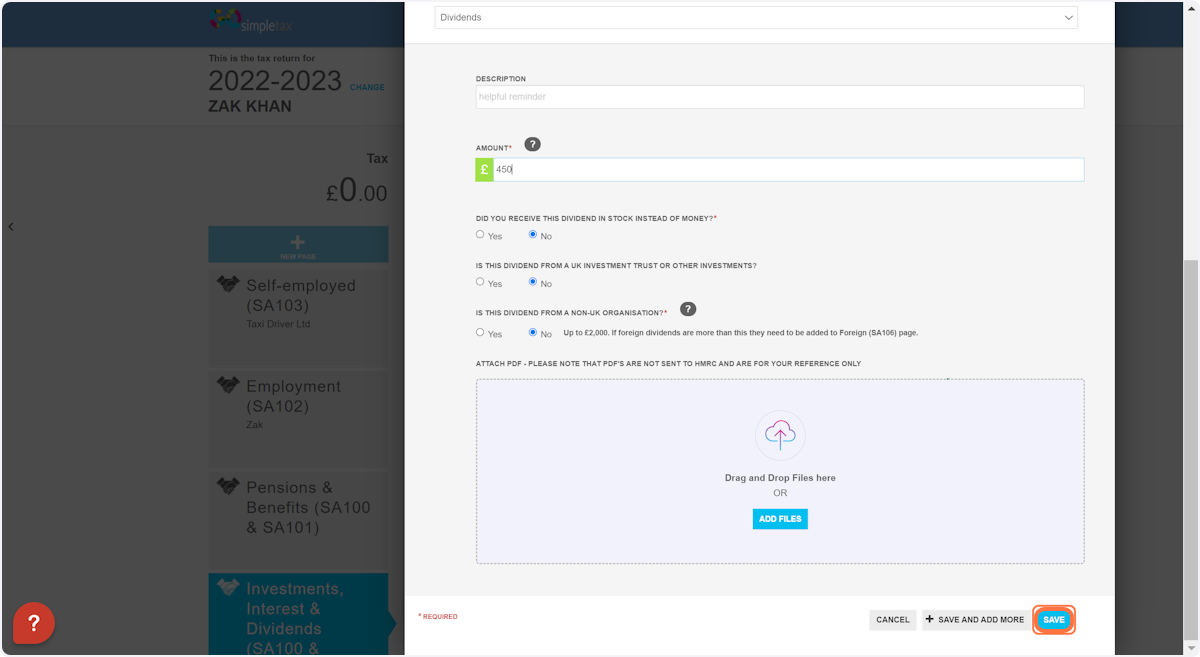

4. Click 'SAVE' once you're happy with your entries

Related Articles

SA100 & SA101: How do I add UK company dividend income?

1. Click on '+ NEW PAGE', then select 'Investments, Interest & Dividends (SA100 & SA101)' 2. Click on '+ INCOME' 3. Select 'Dividends' from the down-down list provided, then enter the amount you'd like to declare 4. Click 'SAVE' once you're happy ...

SA100 SA101 : Investments, Interest and Dividends

Almost all income obtained through interest or dividends must enter your Tax Return and most investments are entitled to tax relief. Annual investment statements may show three amounts: ‘gross interest’, ‘tax deducted’ and ‘net interest’. You must ...

SA100 TR 3 Box 4: How do I record Dividends from UK companies?

Click on ADD NEW PAGE on the left of the screen Select Investments, Interest & Dividends (SA100 & SA101) To begin recording the Income Click ADD INCOME Choose the 'Dividend' Category from the drop down list and update the description with the company ...

SA100 : How do I record Investments & Dividends?

Click on ADD NEW PAGE on the left of the screen Select Investments, Interest & Dividends (SA100 & SA101) To begin recording the Income Click ADD INCOME Choose the Category from the drop down list

SA100 TR 3 Box 5: How do I record other Dividends?

Click on ADD NEW PAGE on the left of the screen Select Investments, Interest & Dividends (SA100 & SA101) To begin recording the Income Click ADD INCOME Choose the 'Dividend' Category from the drop down list and update the description with the company ...