SA109: How do I claim split year treatment?

How do I claim split year treatment?

To include split year treatment claim on your tax return, follow the instructions below. Please note, you should pay attention to the other questions on this page not covered in this guide, these are different for everyone and therefore there is no specific instructions.

Please use HMRC help notes where relevant, we have included the link to the split year manuals and also SA109 help notes.

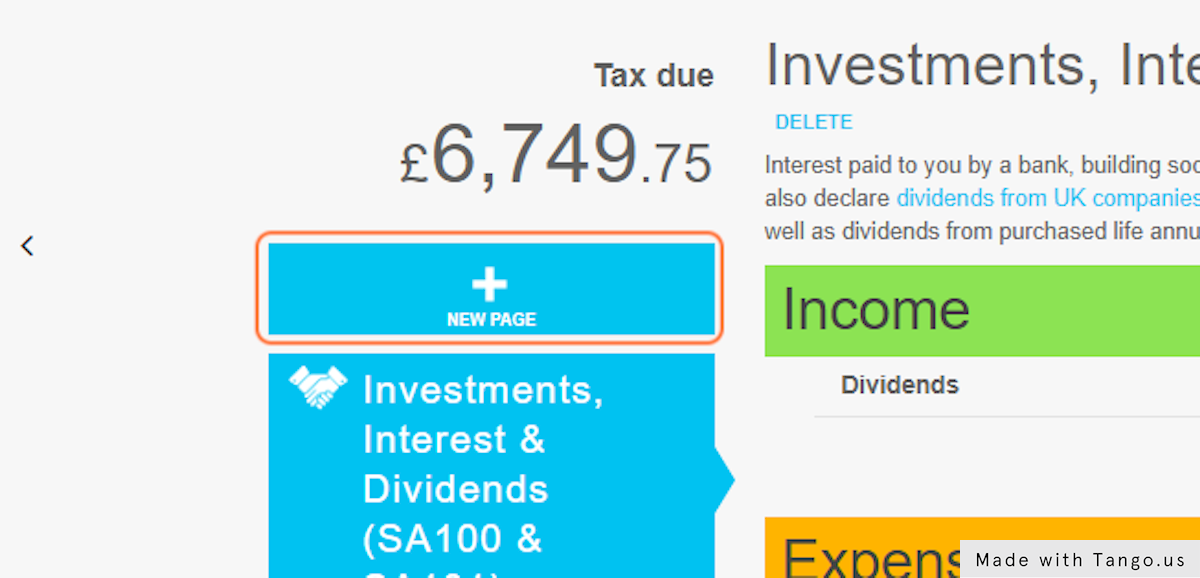

1. Click on NEW PAGE

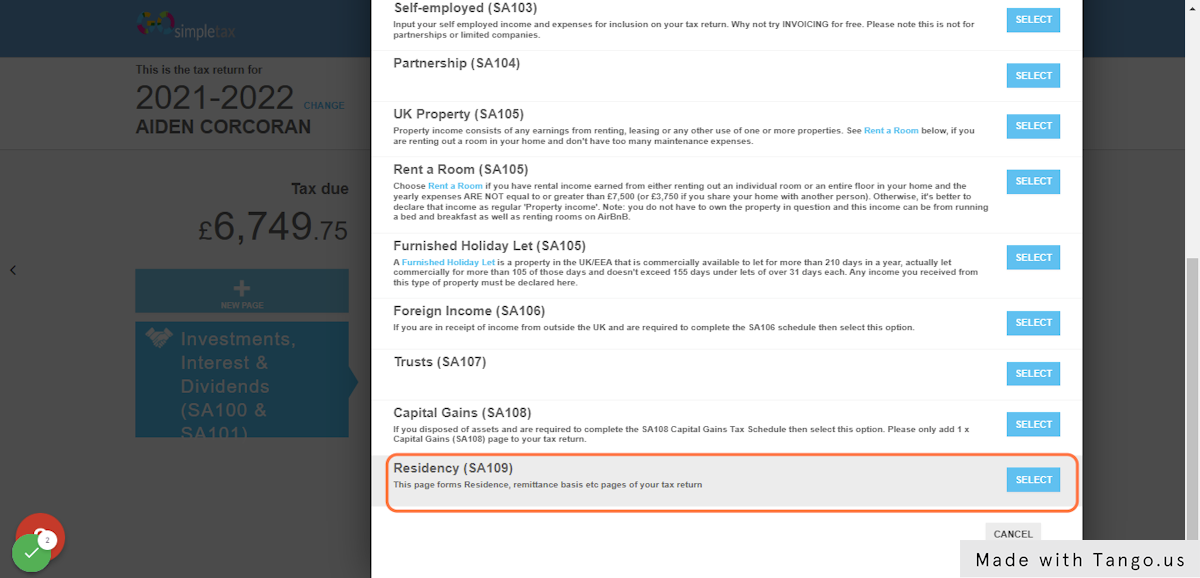

2. Locate the Residency (SA109) page

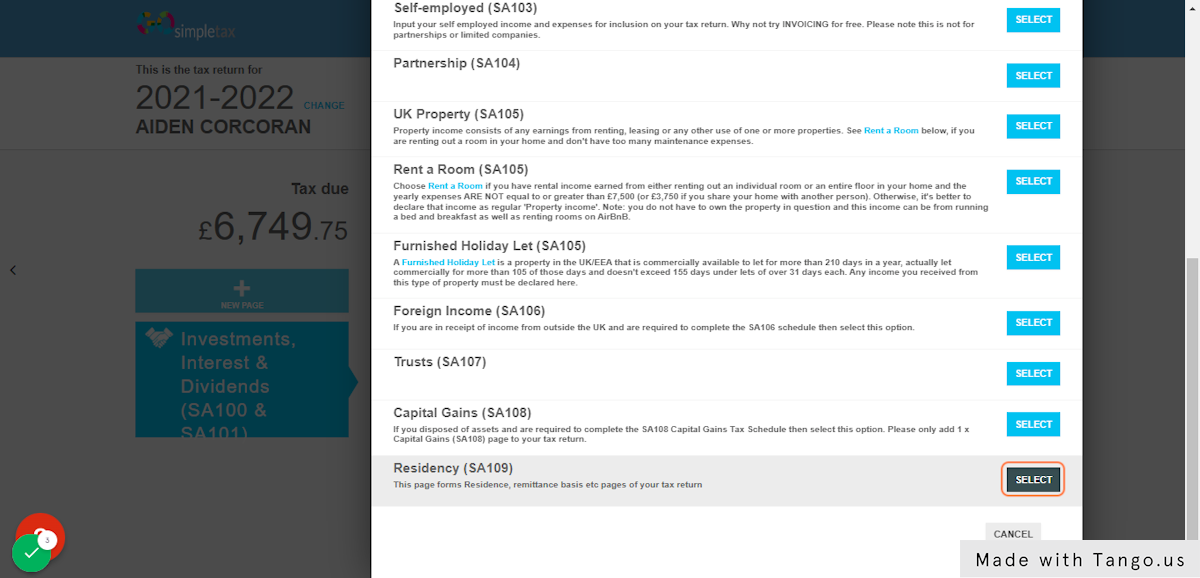

3. Click on SELECT to add the Residency (SA109) page

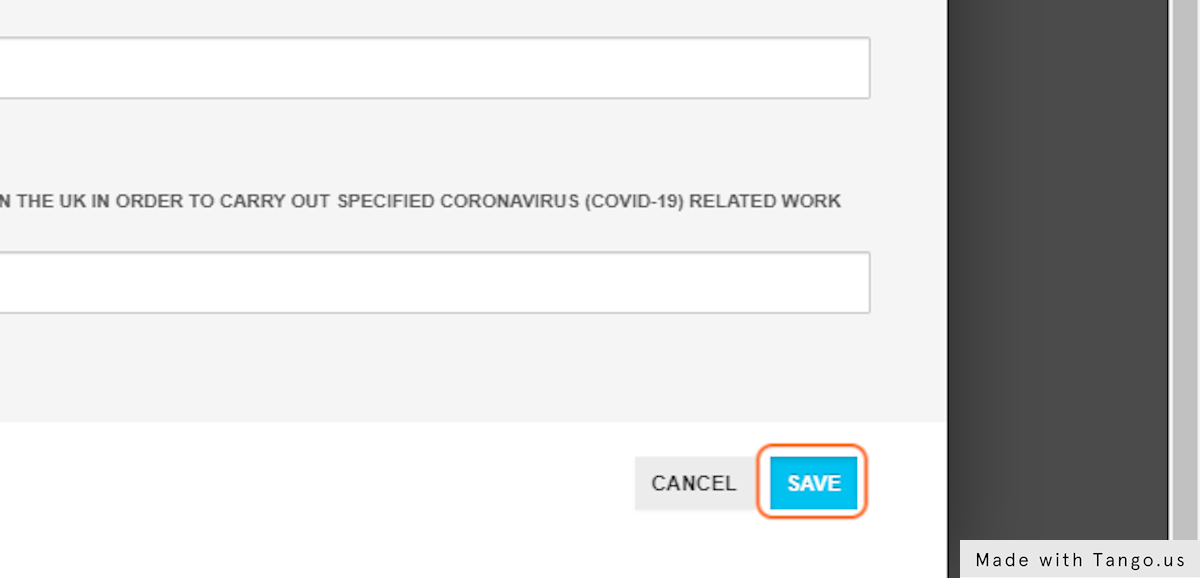

4. Ignore questions for now and scroll down to click on SAVE

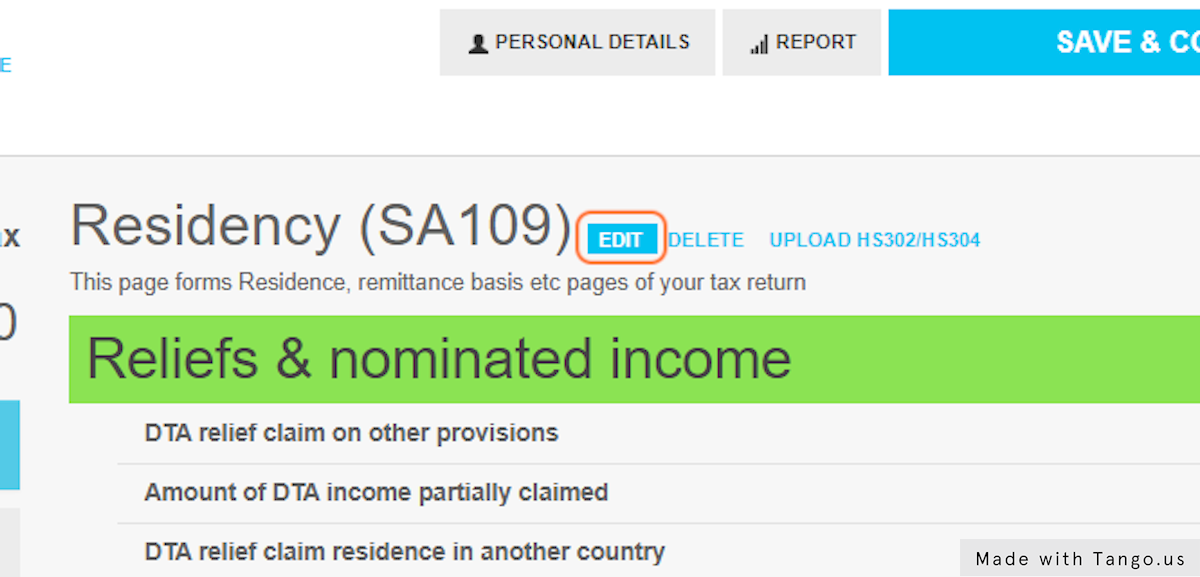

5. Now the Residency SA109 page has been added, press EDIT

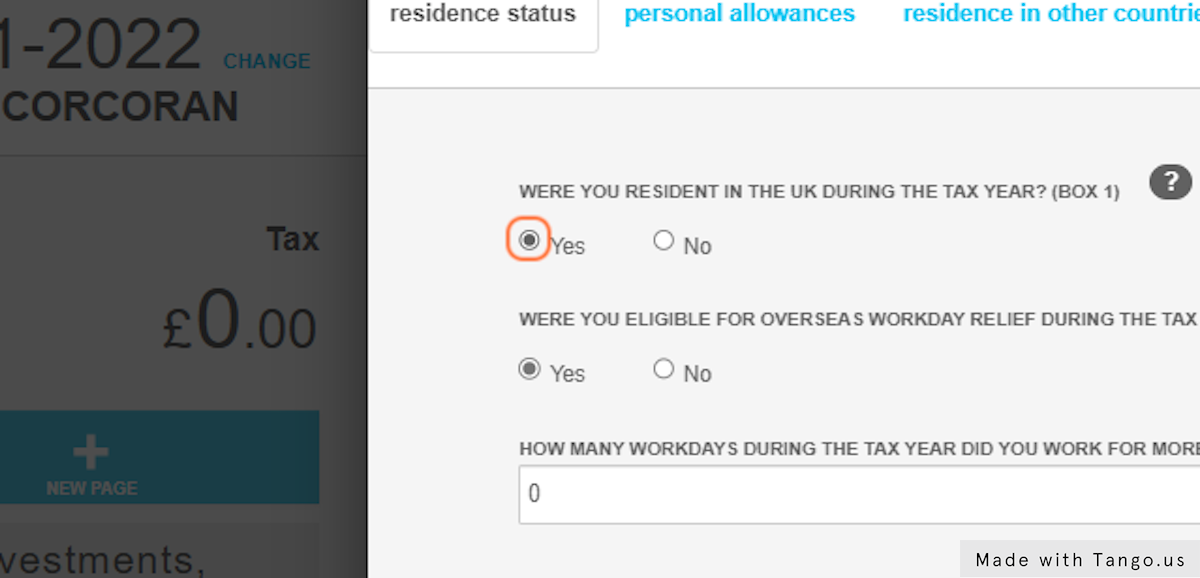

6. If you are claiming split year treatment, you must answer 'YES' to were you resident in the UK during the tax year

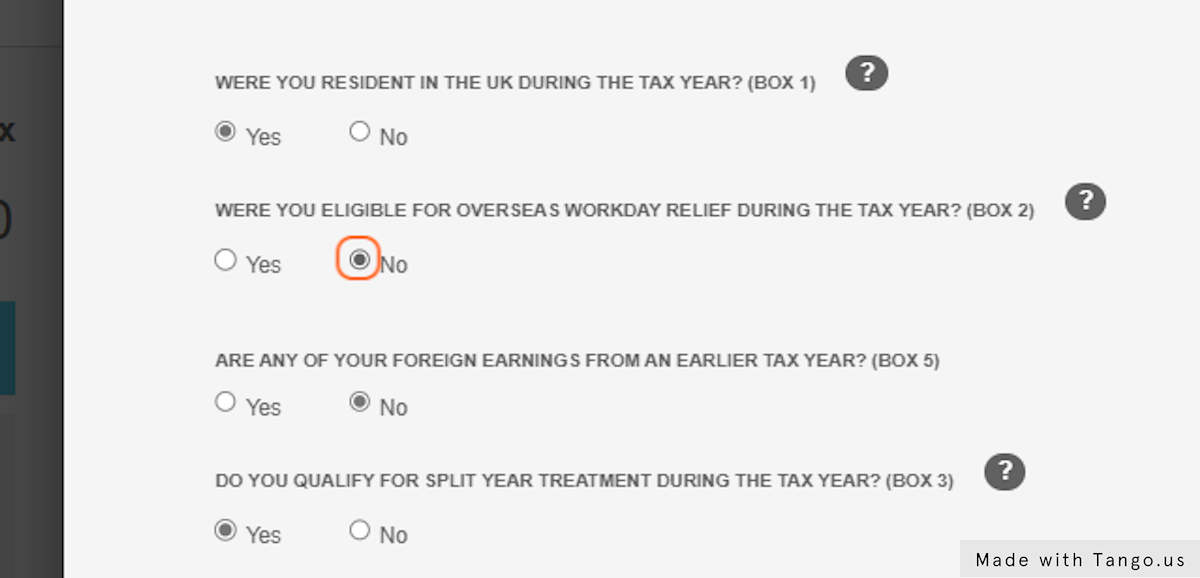

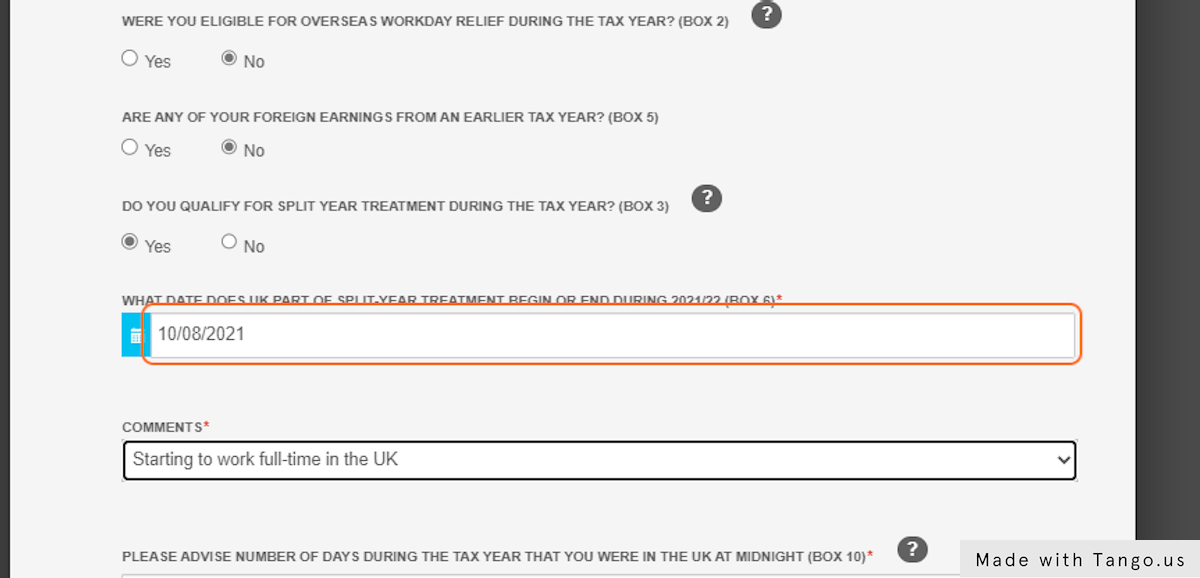

7. Answer 'NO' to Box 2 if it isn't relevant to you

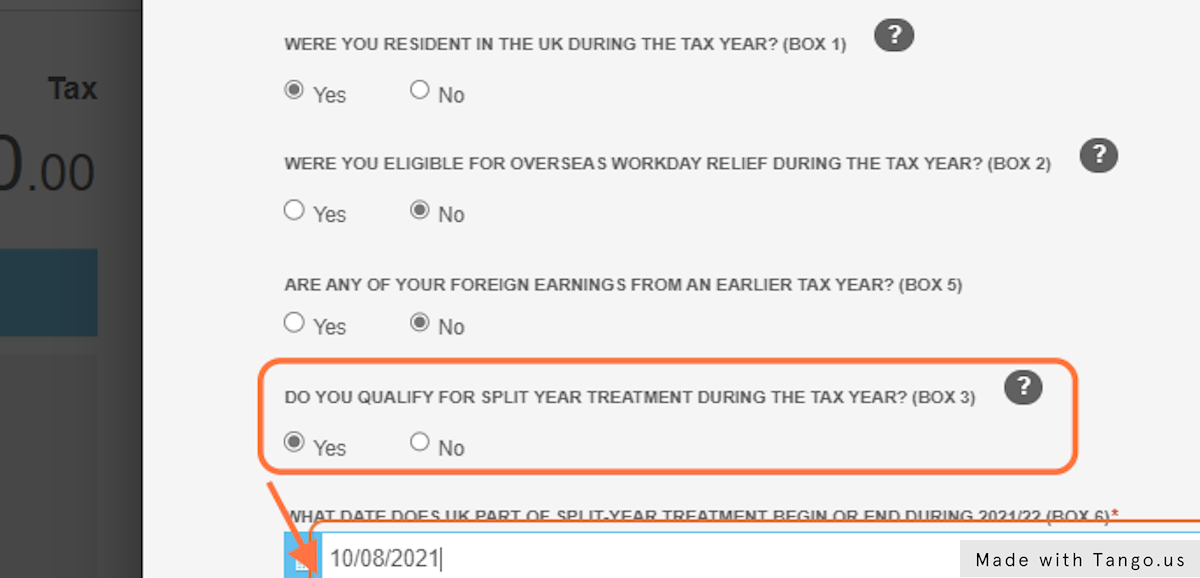

8. Answer 'YES' to Box 3 to claim split year treatment and enter the date it applies from underneath

9. Next, choose from the dropdown menu under 'COMMENTS' which case applies to you for split year treatment

Use HMRC manuals to check which 'case' applies to you: https://www.gov.uk/hmrc-internal-manuals/residence-domicile-and-remittance-basis/rdrm12000

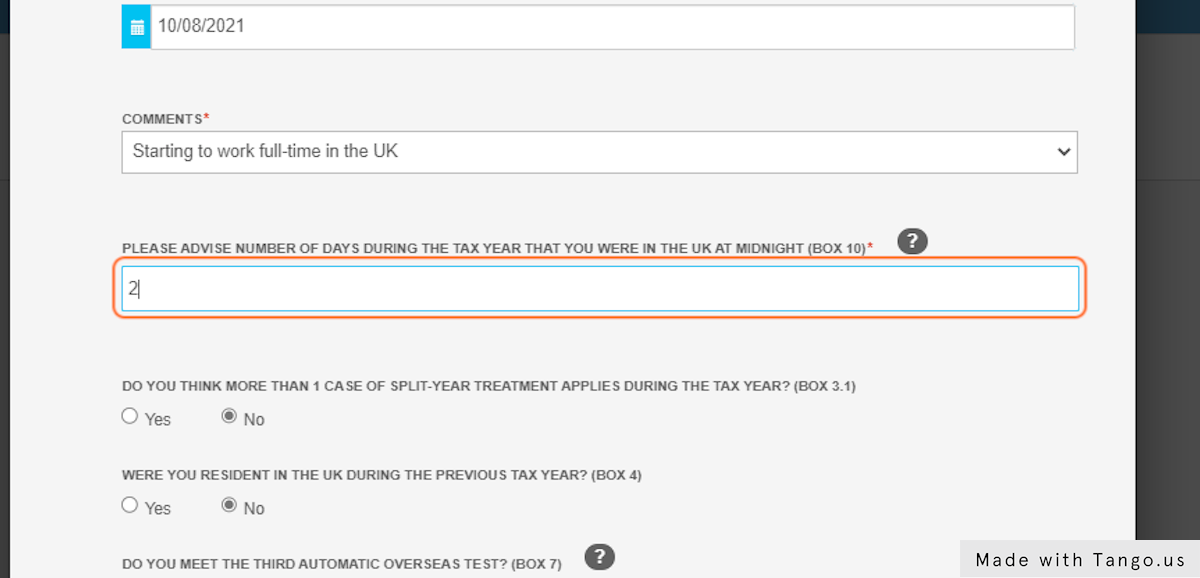

10. As you have put an 'X' in Box 3 because you are claiming split year treatment, you need to complete Box 10. This relates to how many days you were in the UK during the overseas period of the split year

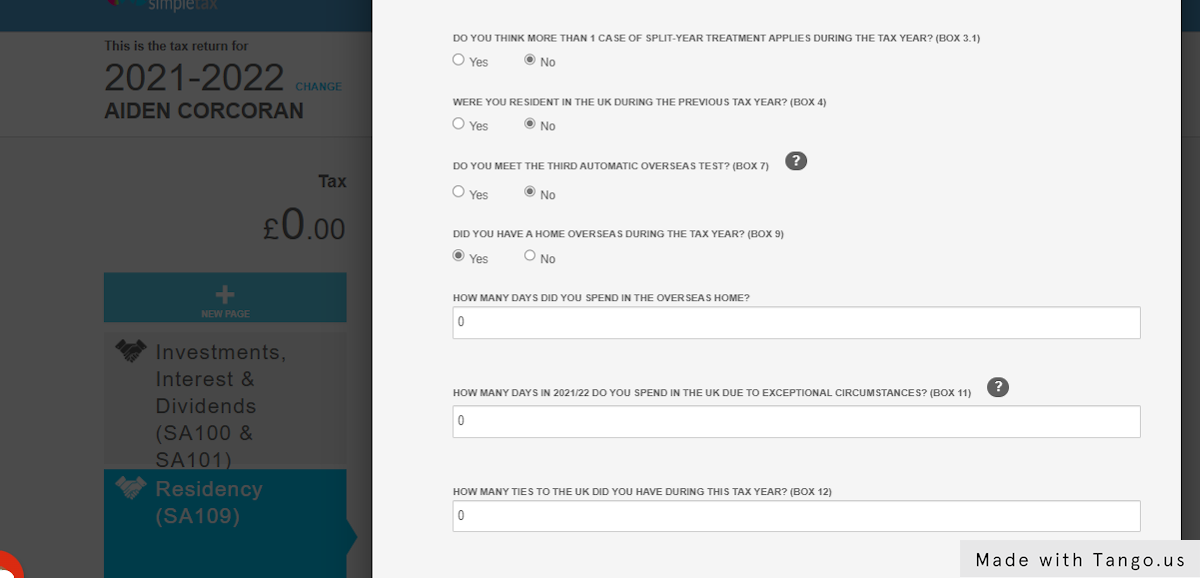

11. Read the remainder of the questions of this page and answer what is relevant to you. I would suggest you use the SA109 help notes to assist with this. Reference HMRC help notes with the boxes in brackets after each question

HMRC help notes link: https://www.gov.uk/government/publications/self-assessment-residence-remittance-basis-etc-sa109

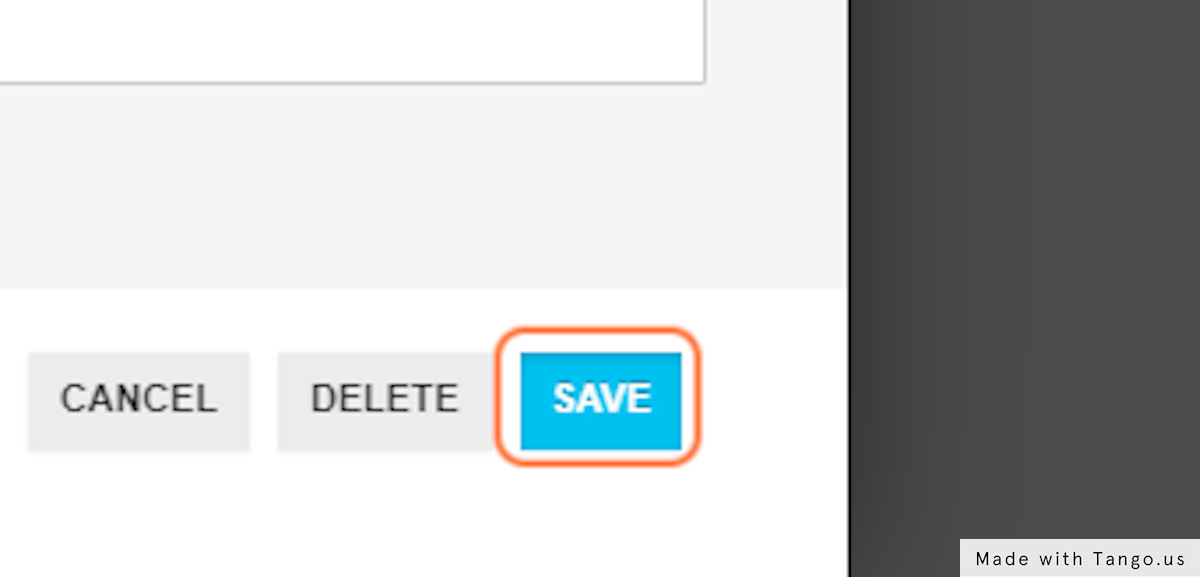

12. Once you are happy with your entries, click on SAVE

What income do I report?

Because you are claiming split year, your tax year is split into two. 1. Non-resident period and 2. Resident period.

During period 1 you are only required to include your UK sourced income

During period 2 you are required to report worldwide income

Related Articles

SA109 : Guide to split year treatment as non-resident leaver

When you leave the UK during a tax year, you still have reporting responsibilities with HMRC for the year you leave and perhaps beyond. It can be a confusing bunch of affairs but hopefully this guide will help alleviate those headaches. It is worth ...SA109 : Non Resident Case Study 2 - Leaving UK & Split Year Treatment partner joins at later date.

CASE STUDY 2 Case Study 1 RECAP: 'Venessa left the UK on 1 November 2019 to work permanently in France. She currently completes a tax return as she receives dividend income from her UK investments and also rents out a property. She has always been ...SA109 : Non Resident Case Study 1 - Leaving UK & Split Year Treatment

CASE STUDY 1 Venessa left the UK on 1 November 2019 to work permanently in France. She currently completes a tax return as she receives dividend income from her UK investments and also rents out a property. She has always been UK resident. She ...SA109 : Non Resident Case Study 3 - Leaving UK & Split Year Treatment with return visits to the UK

CASE STUDY 3 Kirk emigrated from the UK on 6 January 2020 to live with his girlfriend Akiko in Japan. He had always previously been resident in the UK. Kirk moved out of his UK home on 5 January 2020. The property is currently on the market to be ...SA103 : Self-Employed-Expenses-What-Can-I-Claim

What types of expenses are there? Capital - This is the cost of buying, creating or improving a business asset, used to increase profit. The cost of buying a van for your business would be capital expenditure. Other examples include buying machinery, ...