Where do I enter my discount code?

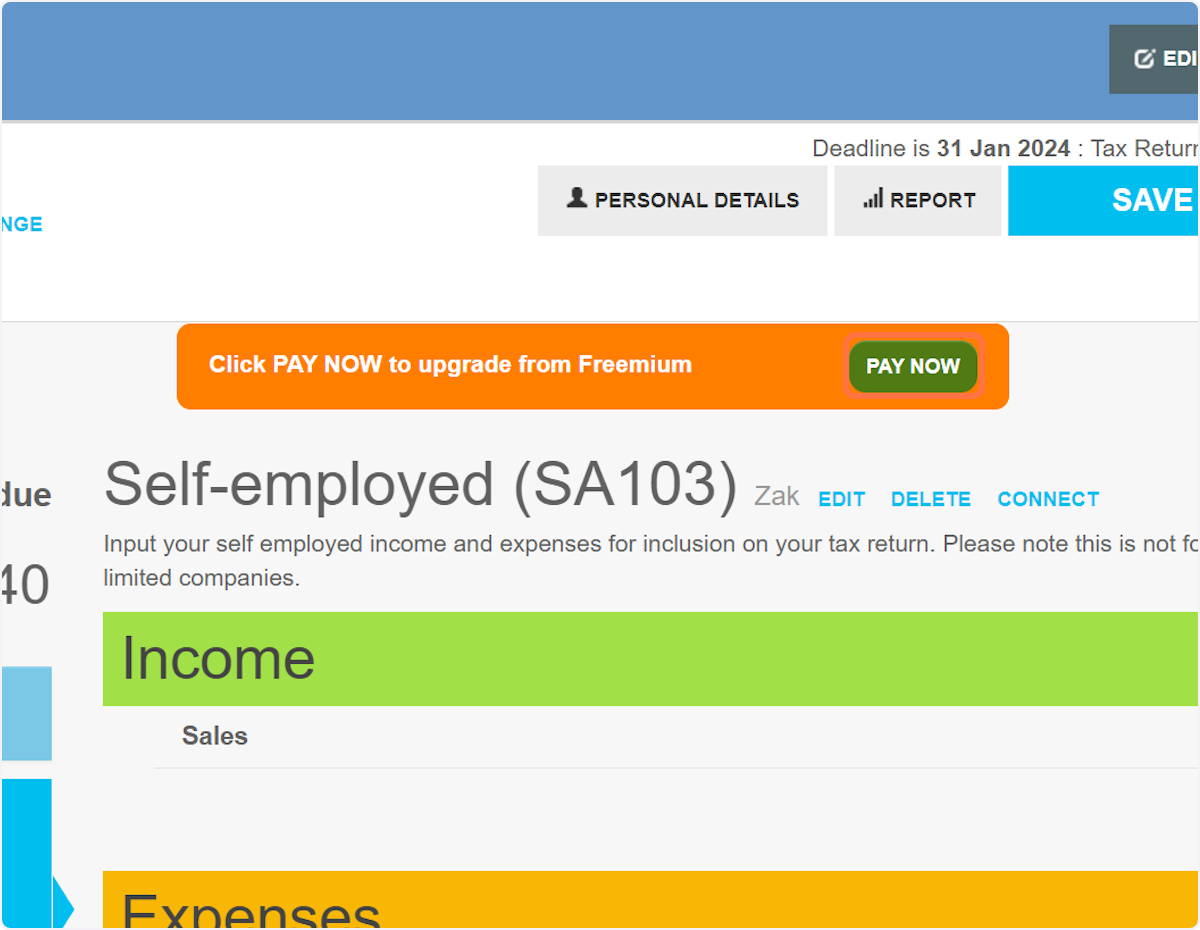

1. Click on 'PAY NOW'

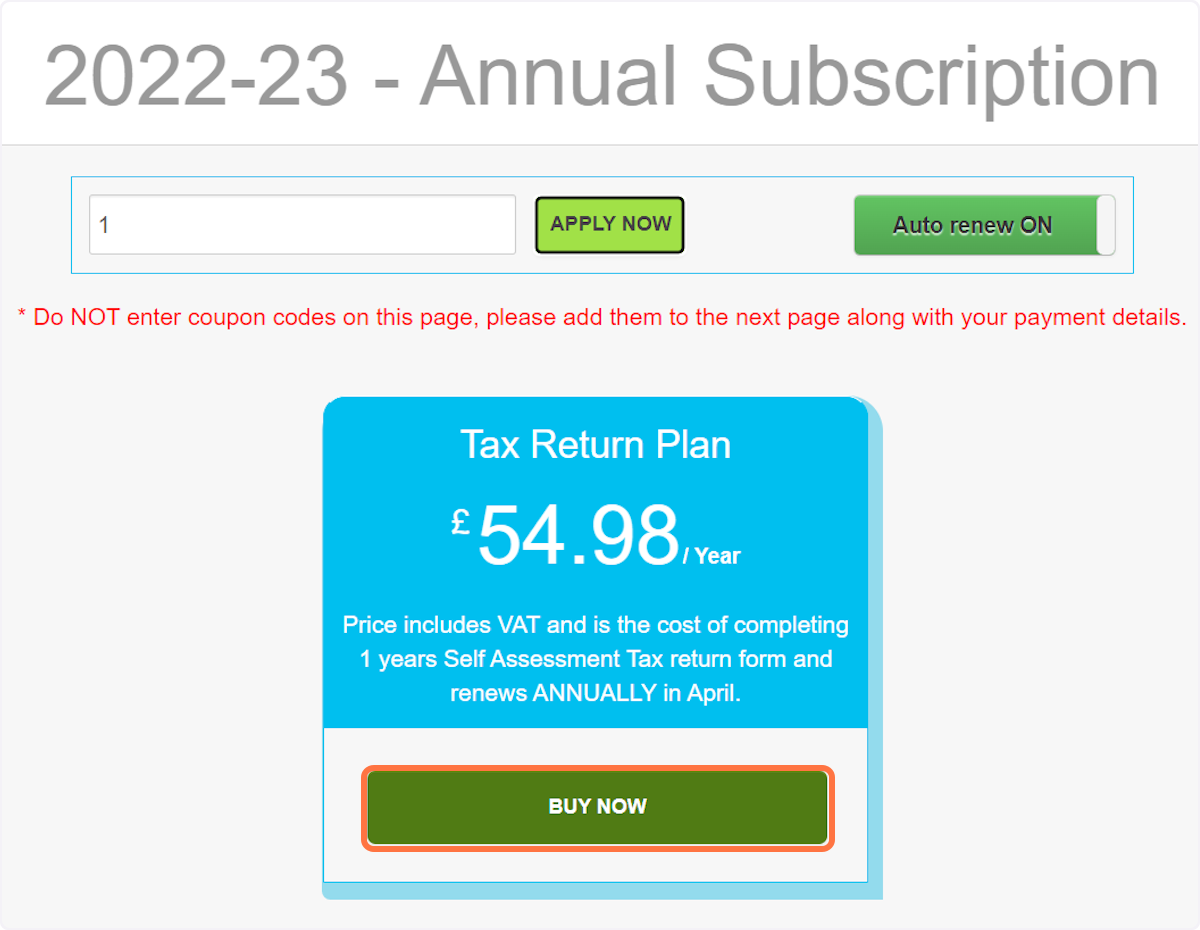

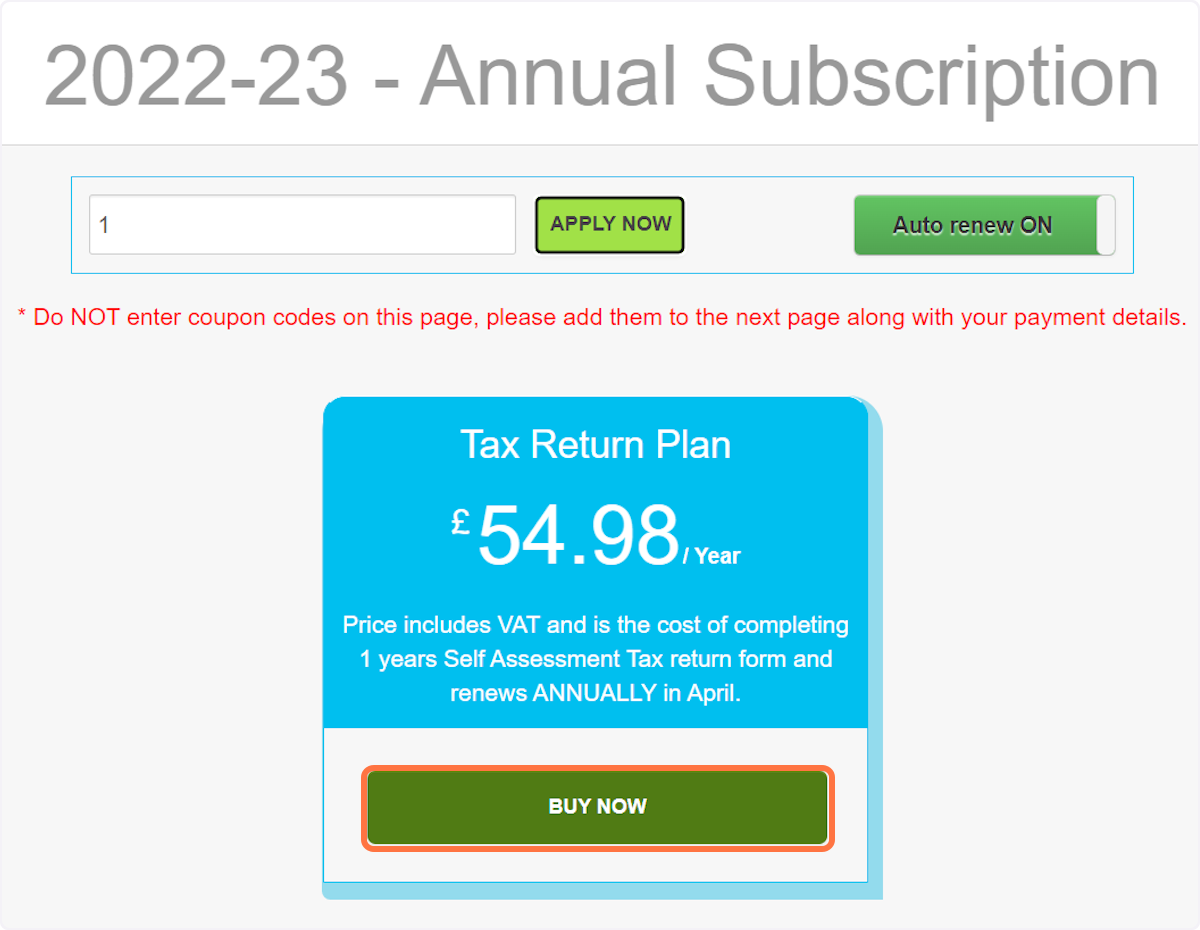

2. Enter the amount of users you'd like on your account in the box provided, click 'APPLY NOW', followed by 'BUY NOW'

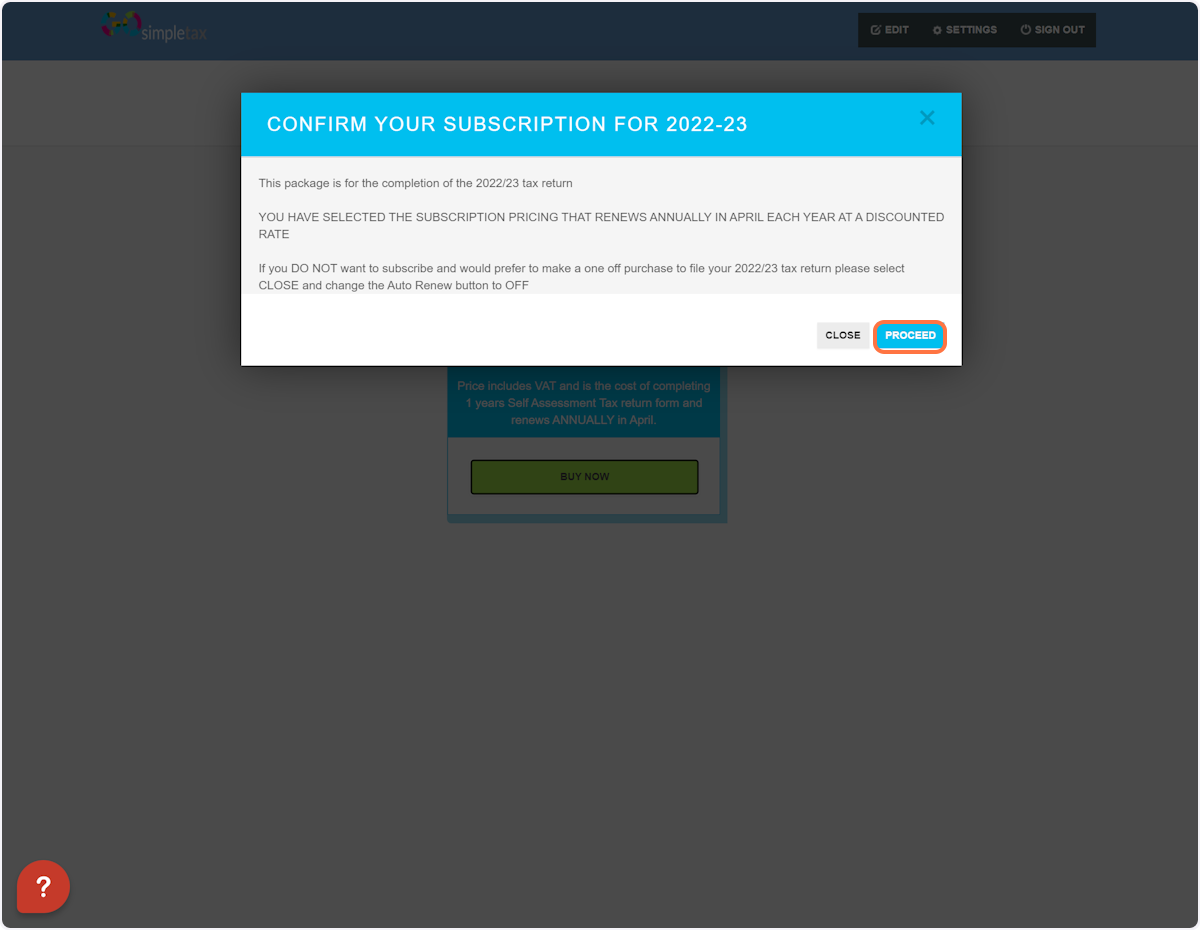

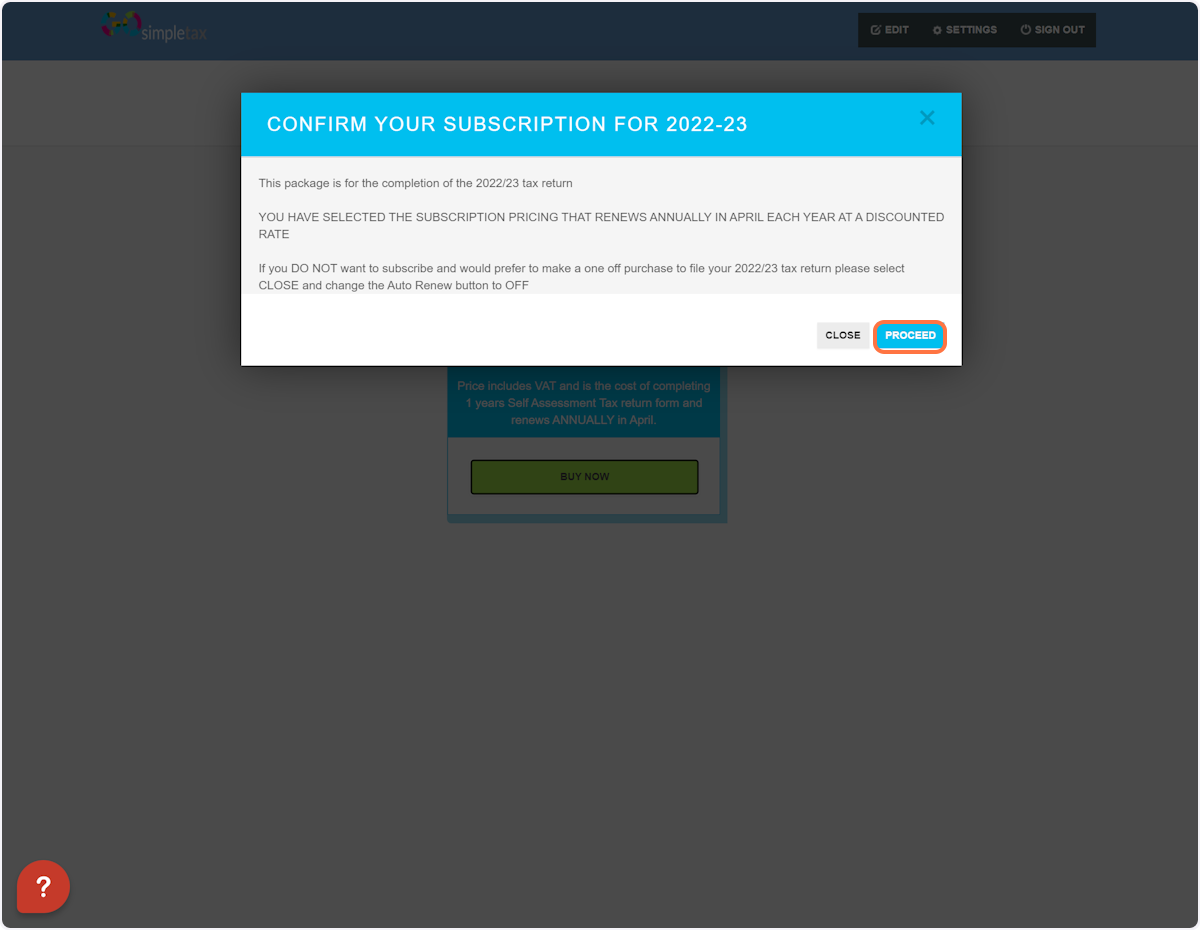

3. Click on 'PROCEED'

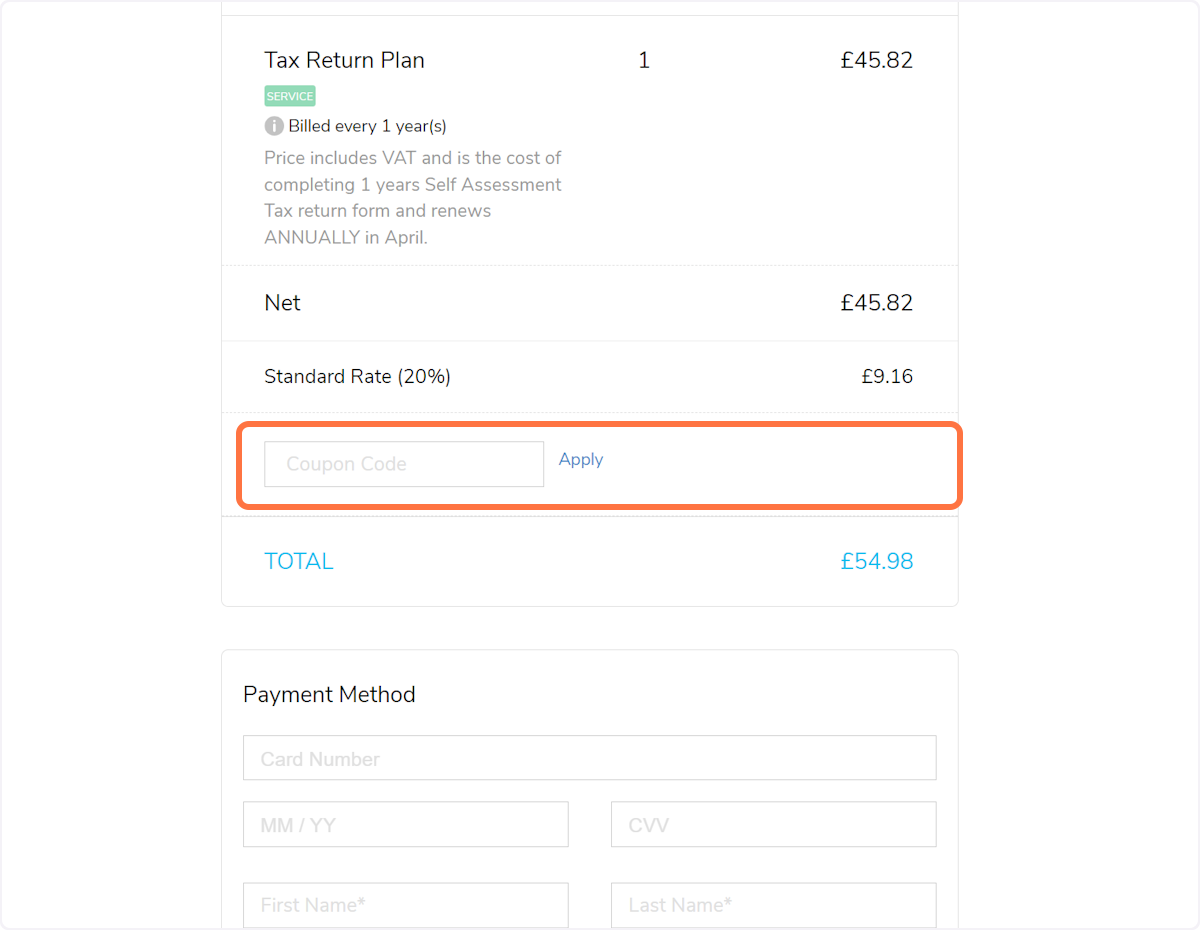

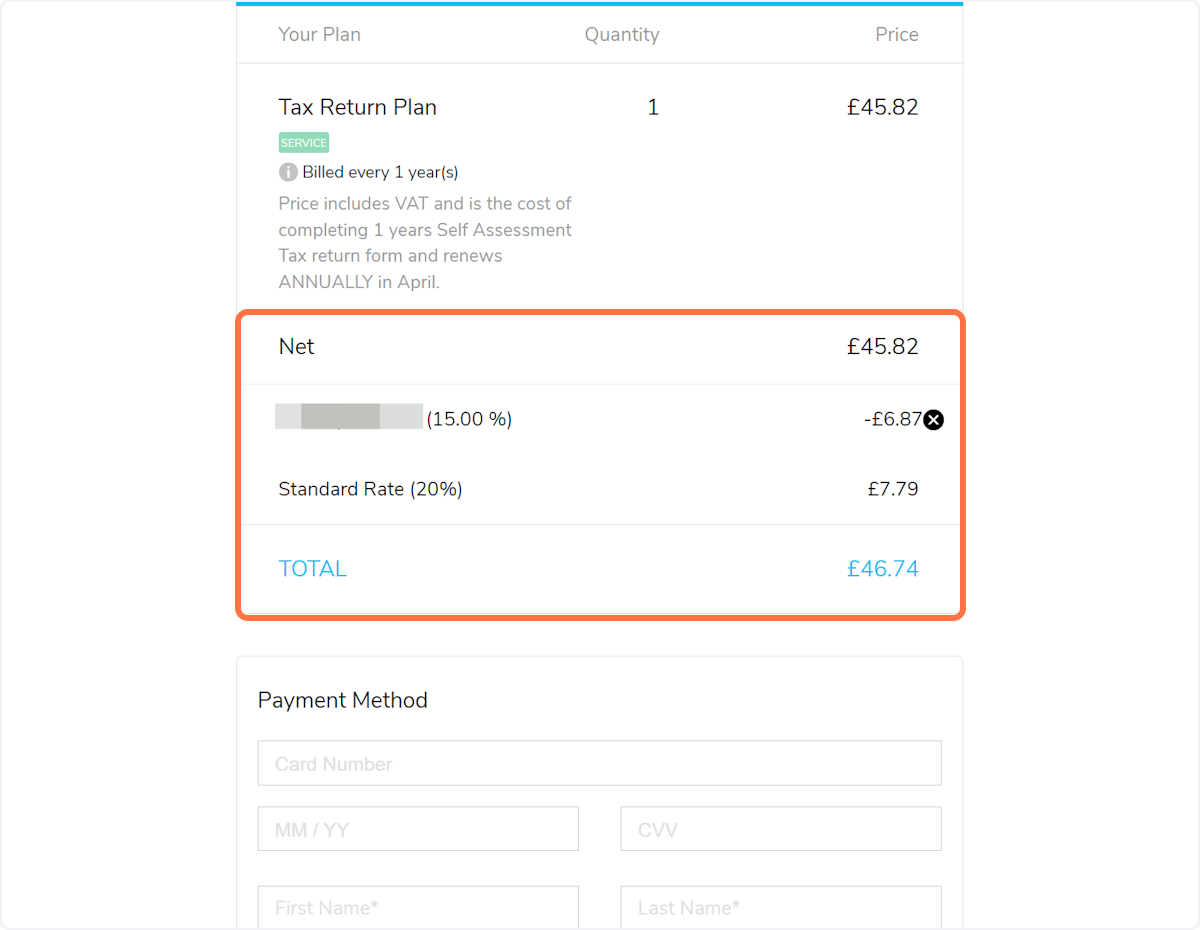

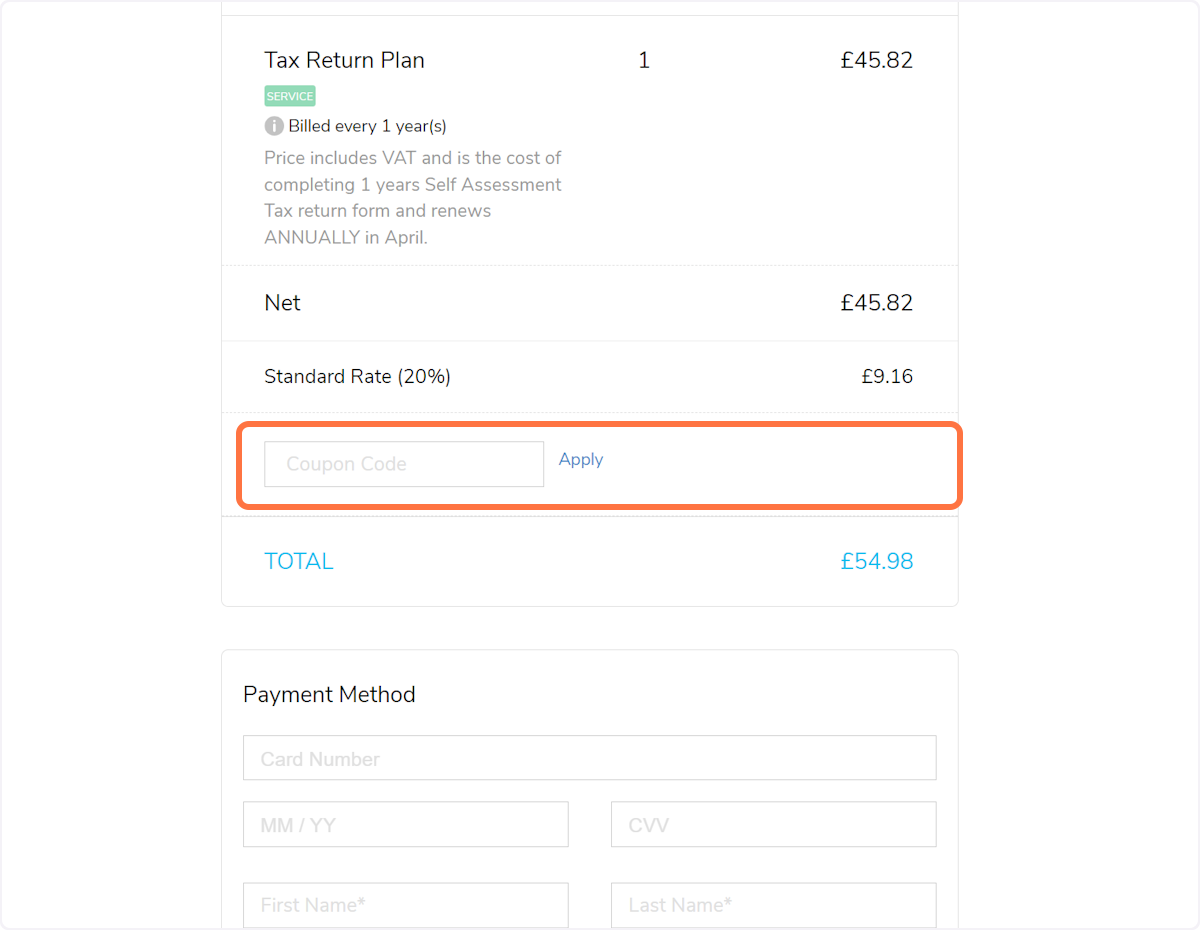

4. As can be seen in the outlined box below, this is where you can enter your discount code

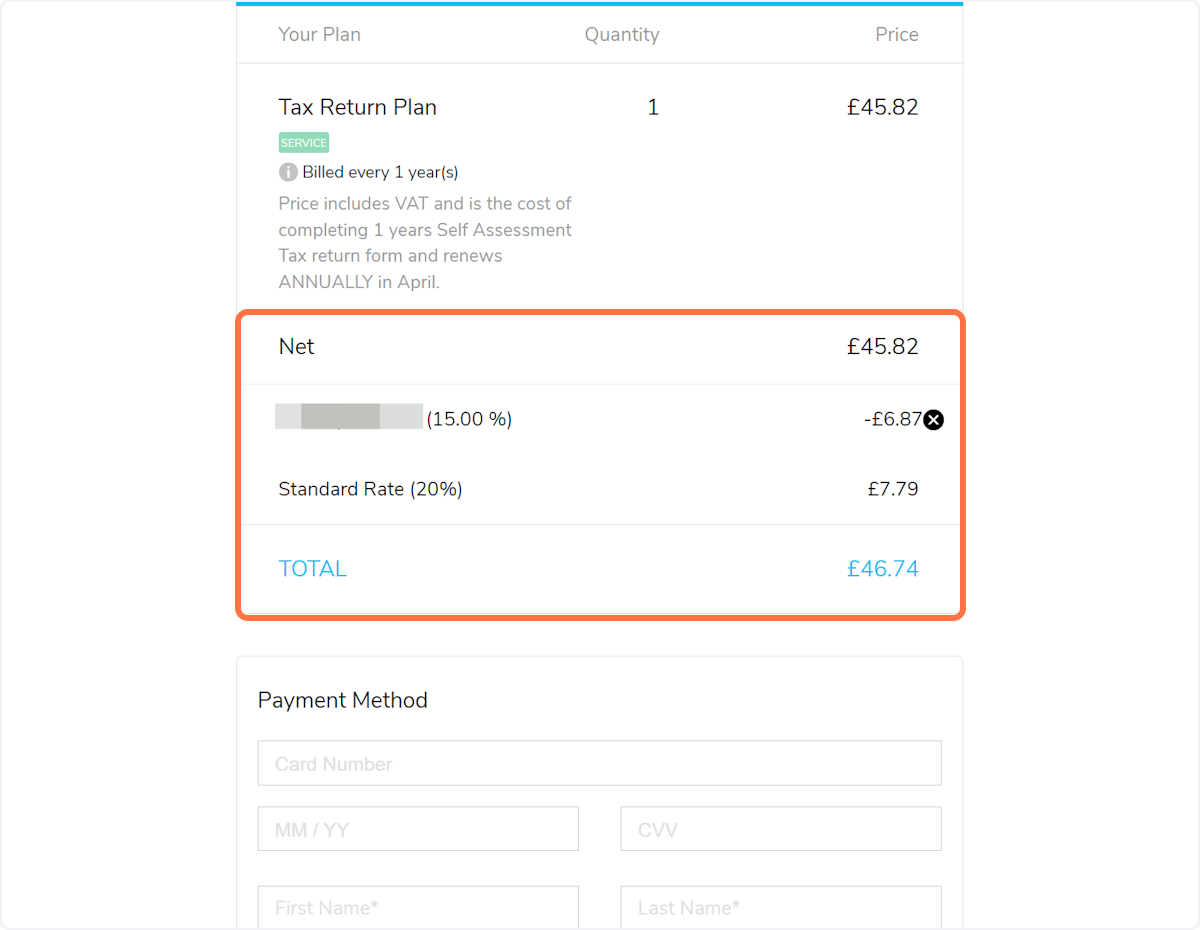

5. After you click 'Apply', you'll see your total fee become discounted

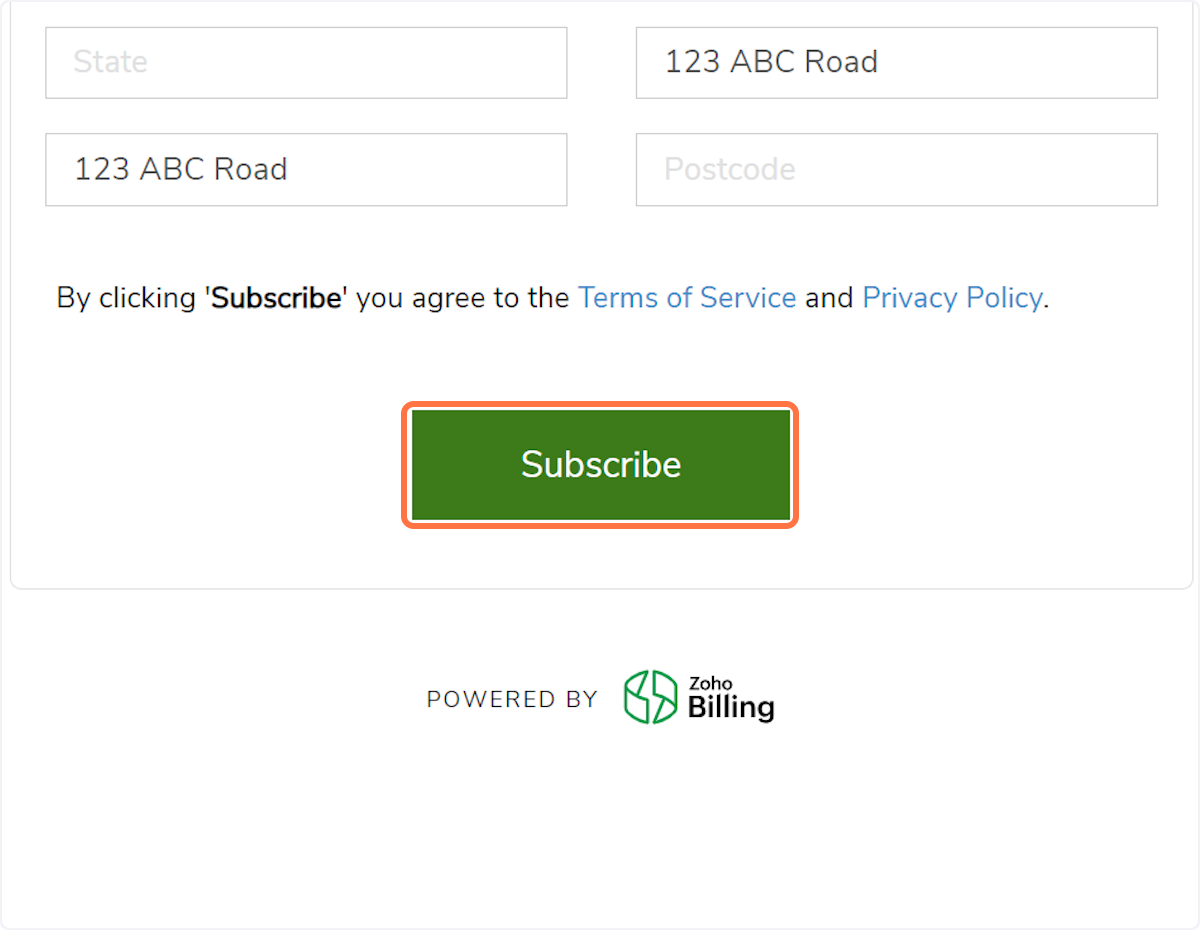

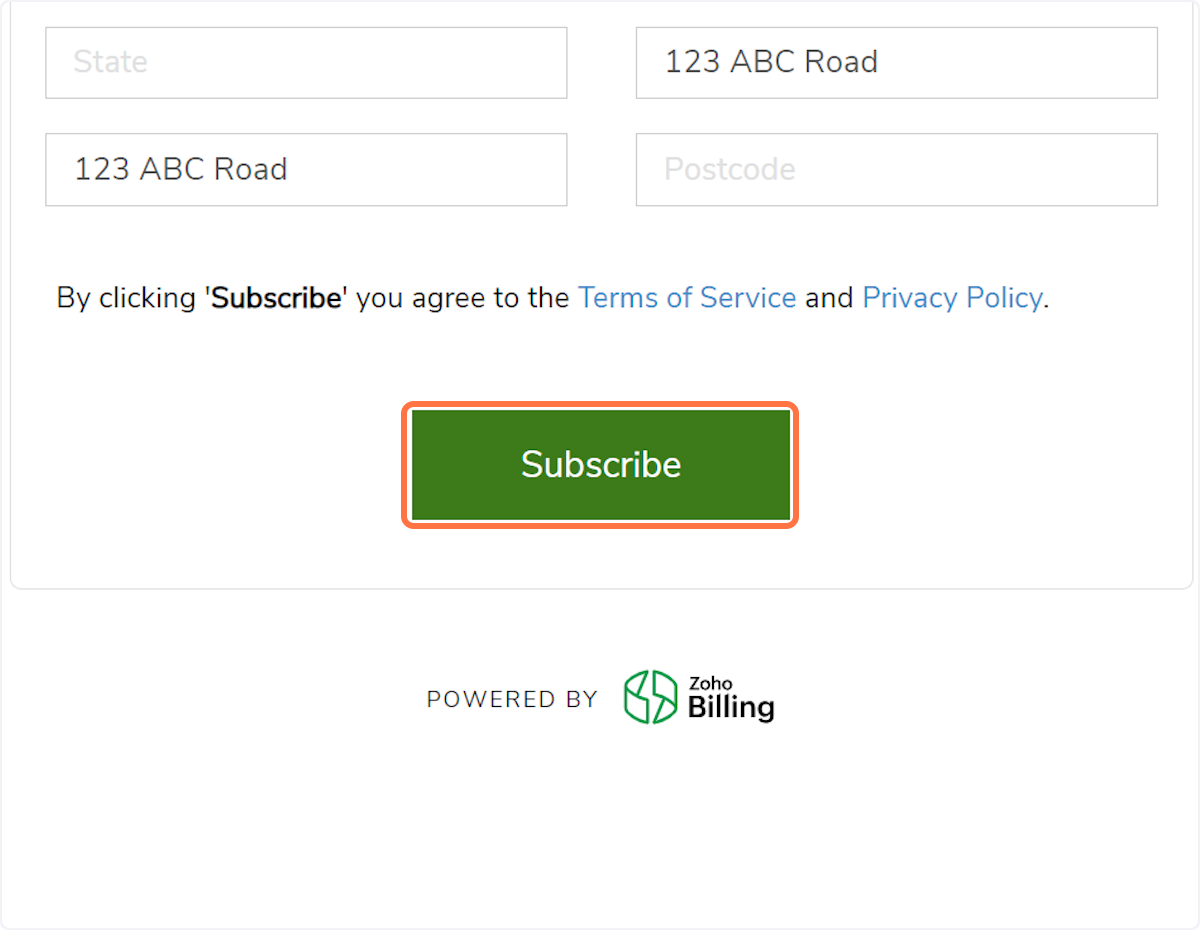

6. Once you've filled in all of your payment details, click 'Subscribe' at the bottom

Related Articles

I had a new customer discount code

Our new customer discount is there to benefit you by lowering the risk of trying GoSimpleTax for the first time, making sure it’s for you. We hope you’ve loved using GoSimpleTax and see that the standard price is great value for the benefits it ...

SA100 TR 6 Box 6: How do I enter my branch sort code?

In the main EDIT page, click SAVE and then CONTINUE: Next click YES: On the ALMOST THERE page, scroll down until you see the question below and tick YES. This will open another question. You then need to tick YES to that question: Boxes will then ...

SA100 TR 6 Box 7: How do I enter my Account Number?

In the main EDIT page, click SAVE and then CONTINUE: Next click YES: On the ALMOST THERE page, scroll down until you see the question below and tick YES. This will open another question. You then need to tick YES to that question: Boxes will then ...

SA100 TR 6 Box 8: How do I enter my Building Society Reference Number?

In the main EDIT page, click SAVE and then CONTINUE: Next click YES: On the ALMOST THERE page, scroll down until you see the question below and tick YES. This will open another question. You then need to tick YES to that question: Boxes will then ...

SA103F Box 4: How do I add my business post code?

To add your business post code on the Self Employed Full pages (turnover over £90,000), please follow the steps below: If you have not added the Self Employed page already, please click on + NEW PAGE on the left of the screen. Select Self Employment ...